Page 319 - Southlake FY22 Budget

P. 319

DEBT SErVICE FUnDS EXPEnDITUrES

The City issues general obligation bonds, certificates of obligation, combination tax and revenue certificates of

obligation and tax notes to provide for the acquisition and construction of major capital facilities and infrastructure.

Certificates of obligation are used to fund construction of city facilities such as buildings, roads and sidewalks. Revenue

bonds are used to fund construction of city infrastructure such as water and sewer system improvements as well as

park improvements.

We want to help you understand the City’s use of debt by explaining the types of projects that we fund by borrowing

money, and what kind of bonds we use. This section will also help you understand the obligations the City currently

has, and how we balance the need to implement the City’s master plans with fiscal responsibility.

It is important to note that our debt management strategies receive a rigorous annual review from bond rating agencies

tasked with letting potential borrowers know how credit-worthy the city is. Right now the City has two AAA ratings — a

strong external endorsement of the City’s financial management.

Tax suPPOrTed vs. self-suPPOrTing deBT

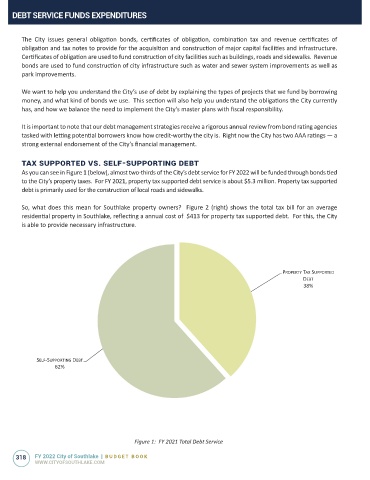

As you can see in Figure 1 (below), almost two-thirds of the City’s debt service for FY 2022 will be funded through bonds tied

to the City’s property taxes. For FY 2021, property tax supported debt service is about $5.3 million. Property tax supported

debt is primarily used for the construction of local roads and sidewalks.

So, what does this mean for Southlake property owners? Figure 2 (right) shows the total tax bill for an average

residential property in Southlake, reflecting a annual cost of $413 for property tax supported debt. For this, the City

is able to provide necessary infrastructure.

PROPERTY TAX SUPPORTED

DEBT

38%

SELF-SUPPORTING DEBT

62%

Figure 1: FY 2021 Total Debt Service

318 FY 2022 City of Southlake | BUDGET BOOK

WWW.CITYOFSOUTHLAKE.COM