Page 2 - Southlake FY22 Budget

P. 2

Filed September 29, 2022

Tarrant County Clerk's Office

City of Southlake, Texas Mary Louise Nicholson

Tarrant County Clerk

Fiscal Year 2022

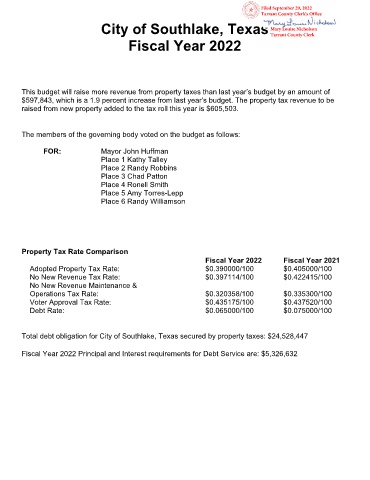

This budget will raise more revenue from property taxes than last year’s budget by an amount of

$597,843, which is a 1.9 percent increase from last year’s budget. The property tax revenue to be

raised from new property added to the tax roll this year is $605,503.

The members of the governing body voted on the budget as follows:

FOR: Mayor John Huffman

Place 1 Kathy Talley

Place 2 Randy Robbins

Place 3 Chad Patton

Place 4 Ronell Smith

Place 5 Amy Torres-Lepp

Place 6 Randy Williamson

Property Tax Rate Comparison

Fiscal Year 2022 Fiscal Year 2021

Adopted Property Tax Rate: $0.390000/100 $0.405000/100

No New Revenue Tax Rate: $0.397114/100 $0.422415/100

No New Revenue Maintenance &

Operations Tax Rate: $0.320358/100 $0.335300/100

Voter Approval Tax Rate: $0.435175/100 $0.437520/100

Debt Rate: $0.065000/100 $0.075000/100

Total debt obligation for City of Southlake, Texas secured by property taxes: $24,528,447

Fiscal Year 2022 Principal and Interest requirements for Debt Service are: $5,326,632