Page 108 - Southlake FY22 Budget

P. 108

CITY PrOFILE

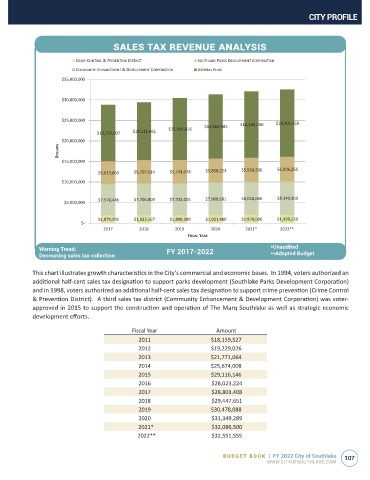

sales Tax revenue analysis

CRIME CONTROL & PREVENTION DISTRICT SOUTHLAKE PARKS DEVELOPMENT CORPORATION

COMMUNITY ENHANCEMENT & DEVELOPMENT CORPORATION GENERAL FUND

$35,000,000

$30,000,000

$25,000,000 $16,405,450

$15,660,985 $16,166,000

$15,104,616

$13,732,007 $14,111,661

$20,000,000

DOLLARS

$15,000,000

$5,613,663 $5,707,414 $5,734,078 $5,858,223 $5,930,500 $6,006,255

$10,000,000

$7,578,446 $7,705,009 $7,741,005 $7,908,601 $8,020,000 $8,140,300

$5,000,000

$1,879,292 $1,923,567 $1,898,389 $1,921,480 $1,970,000 $1,999,550

$-

2017 2018 2019 2020 2021* 2022**

FISCAL YEAR

Warning Trend: FY 2017-2022 *Unaudited

Decreasing sales tax collection **Adopted Budget

This chart illustrates growth characteristics in the City’s commercial and economic bases. In 1994, voters authorized an

additional half-cent sales tax designation to support parks development (Southlake Parks Development Corporation)

and in 1998, voters authorized an additional half-cent sales tax designation to support crime prevention (Crime Control

& Prevention District). A third sales tax district (Community Enhancement & Development Corporation) was voter-

approved in 2015 to support the construction and operation of The Marq Southlake as well as strategic economic

development efforts.

Fiscal Year Amount

2011 $18,159,527

2012 $19,229,026

2013 $21,771,064

2014 $25,674,008

2015 $29,116,146

2016 $28,023,224

2017 $28,803,408

2018 $29,447,651

2019 $30,478,088

2020 $31,349,289

2021* $32,086,500

2022** $32,551,555

BUDGET BOOK | FY 2022 City of Southlake 107

WWW.CITYOFSOUTHLAKE.COM