Page 24 - Richland Hills FY22 Annual Budget

P. 24

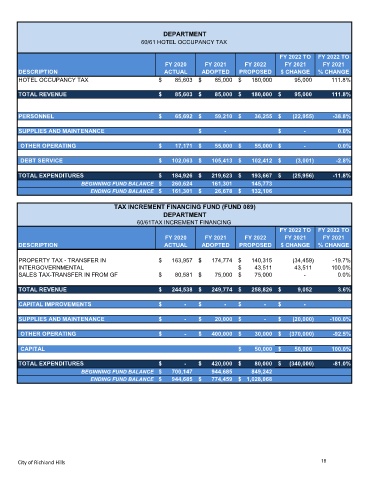

DEPARTMENT

60/61 HOTEL OCCUPANCY TAX

FY 2022 TO FY 2022 TO

FY 2020 FY 2021 FY 2022 FY 2021 FY 2021

DESCRIPTION ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

HOTEL OCCUPANCY TAX $ 85,603 $ 85,000 $ 180,000 95,000 111.8%

TOTAL REVENUE $ 85,603 $ 85,000 $ 180,000 $ 95,000 111.8%

PERSONNEL $ 65,692 $ 59,210 $ 36,255 $ (22,955) -38.8%

SUPPLIES AND MAINTENANCE $ - $ - 0.0%

OTHER OPERATING $ 17,171 $ 55,000 $ 55,000 $ - 0.0%

DEBT SERVICE $ 102,063 $ 105,413 $ 102,412 $ (3,001) -2.8%

TOTAL EXPENDITURES $ 184,926 $ 219,623 $ 193,667 $ (25,956) -11.8%

BEGINNING FUND BALANCE $ 260,624 161,301 145,773

ENDING FUND BALANCE $ 161,301 $ 26,678 $ 132,106

TAX INCREMENT FINANCING FUND (FUND 089)

DEPARTMENT

60/61TAX INCREMENT FINANCING

FY 2022 TO FY 2022 TO

FY 2020 FY 2021 FY 2022 FY 2021 FY 2021

DESCRIPTION ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

PROPERTY TAX - TRANSFER IN $ 163,957 $ 174,774 $ 140,315 (34,459) -19.7%

INTERGOVERNMENTAL $ 43,511 43,511 100.0%

SALES TAX-TRANSFER IN FROM GF $ 80,581 $ 75,000 $ 75,000 - 0.0%

TOTAL REVENUE $ 244,538 $ 249,774 $ 258,826 $ 9,052 3.6%

CAPITAL IMPROVEMENTS $ - $ - $ - $ -

SUPPLIES AND MAINTENANCE $ - $ 20,000 $ - $ (20,000) -100.0%

OTHER OPERATING $ - $ 400,000 $ 30,000 $ (370,000) -92.5%

CAPITAL $ 50,000 $ 50,000 100.0%

TOTAL EXPENDITURES $ - $ 420,000 $ 80,000 $ (340,000) -81.0%

BEGINNING FUND BALANCE $ 700,147 944,685 849,242

ENDING FUND BALANCE $ 944,685 $ 774,459 $ 1,028,068

City of Richland Hills 18