Page 21 - Richland Hills FY22 Annual Budget

P. 21

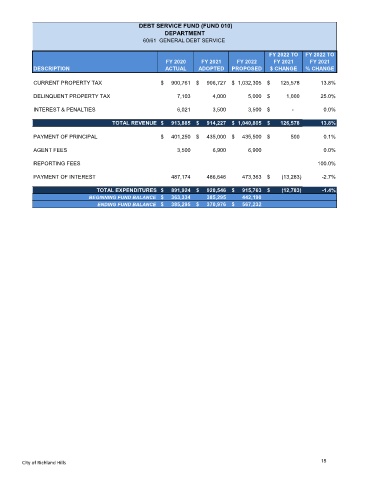

DEBT SERVICE FUND (FUND 010)

DEPARTMENT

60/61 GENERAL DEBT SERVICE

FY 2022 TO FY 2022 TO

FY 2020 FY 2021 FY 2022 FY 2021 FY 2021

DESCRIPTION ACTUAL ADOPTED PROPOSED $ CHANGE % CHANGE

CURRENT PROPERTY TAX $ 900,761 $ 906,727 $ 1,032,305 $ 125,578 13.8%

DELINQUENT PROPERTY TAX 7,103 4,000 5,000 $ 1,000 25.0%

INTEREST & PENALTIES 6,021 3,500 3,500 $ - 0.0%

TOTAL REVENUE $ 913,885 $ 914,227 $ 1,040,805 $ 126,578 13.8%

PAYMENT OF PRINCIPAL $ 401,250 $ 435,000 $ 435,500 $ 500 0.1%

AGENT FEES 3,500 6,900 6,900 0.0%

REPORTING FEES 100.0%

PAYMENT OF INTEREST 487,174 486,646 473,363 $ (13,283) -2.7%

TOTAL EXPENDITURES $ 891,924 $ 928,546 $ 915,763 $ (12,783) -1.4%

BEGINNING FUND BALANCE $ 363,334 385,295 442,190

ENDING FUND BALANCE $ 385,295 $ 370,976 $ 567,232

City of Richland Hills 15