Page 21 - Project Detail Sheet_AdoptedBook

P. 21

ADOPTED | BUDGET

2012 Bond Election Program

During spring 2011, the Community Improvements Task Force was formed to evaluate the current

facility and infrastructure needs. The evaluation was conducted in an eight month period. The

task force recommendation to Council was for the City to construct a new municipal complex. This

recommendation was made after the task force studied the existing location of city services and

departments concluding the Loop 820 expansion impacted city services provided at City Hall,

Police Department, Municipal Court, and Park Administration.

On May 12, 2012, voters elected in favor of the City issuing $48,000,000 in bonds to help fund a

new municipal complex. The new municipal complex will serve as a consolidated location for City

Hall, Police Department, Municipal Court, Parks Administration, Citicable, Fire Administration,

Emergency Management, and Neighborhood Services.

Prior to the 2012 tax year, the City maintained the same tax rate of $0.57 for 19 years. The

approval of the $48 million in the bond election resulted in the City reviewing the $0.57 tax rate.

After review, Council voted to increase the 2012 Tax Rate by 7% to $0.61.

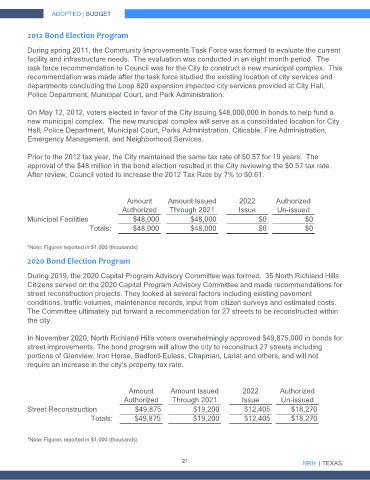

Amount Amount Issued 2022 Authorized

Authorized Through 2021 Issue Un-issued

Municipal Facilities $48,000 $48,000 $0 $0

Totals: $48,000 $48,000 $0 $0

*Note: Figures reported in $1,000 (thousands).

2020 Bond Election Program

During 2019, the 2020 Capital Program Advisory Committee was formed. 35 North Richland Hills

Citizens served on the 2020 Capital Program Advisory Committee and made recommendations for

street reconstruction projects. They looked at several factors including existing pavement

conditions, traffic volumes, maintenance records, input from citizen surveys and estimated costs.

The Committee ultimately put forward a recommendation for 27 streets to be reconstructed within

the city.

In November 2020, North Richland Hills voters overwhelmingly approved $49,875,000 in bonds for

street improvements. The bond program will allow the city to reconstruct 27 streets including

portions of Glenview, Iron Horse, Bedford-Euless, Chapman, Lariat and others, and will not

require an increase in the city’s property tax rate.

Amount Amount Issued 2022 Authorized

Authorized Through 2021 Issue Un-issued

Street Reconstruction $49,875 $19,200 $12,405 $18,270

Totals: $49,875 $19,200 $12,405 $18,270

*Note: Figures reported in $1,000 (thousands).

21

NRH | TEXAS