Page 50 - Microsoft Word - FY 2021 tax info sheet

P. 50

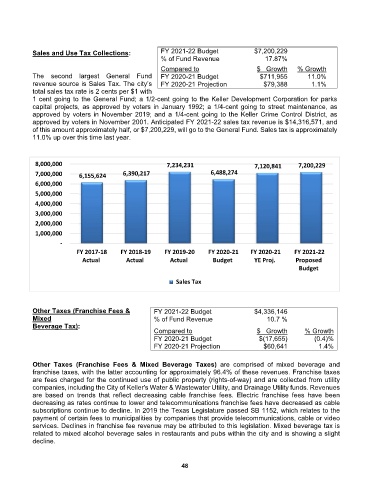

Sales and Use Tax Collections: FY 2021-22 Budget $7,200,229

% of Fund Revenue 17.87%

Compared to $ Growth % Growth

The second largest General Fund FY 2020-21 Budget $711,955 11.0%

revenue source is Sales Tax. The city’s FY 2020-21 Projection $79,388 1.1%

total sales tax rate is 2 cents per $1 with

1 cent going to the General Fund; a 1/2-cent going to the Keller Development Corporation for parks

capital projects, as approved by voters in January 1992; a 1/4-cent going to street maintenance, as

approved by voters in November 2019; and a 1/4-cent going to the Keller Crime Control District, as

approved by voters in November 2001. Anticipated FY 2021-22 sales tax revenue is $14,316,571, and

of this amount approximately half, or $7,200,229, will go to the General Fund. Sales tax is approximately

11.0% up over this time last year.

8,000,000 7,234,231 7,120,841 7,200,229

7,000,000 6,155,624 6,390,217 6,488,274

6,000,000

5,000,000

4,000,000

3,000,000

2,000,000

1,000,000

‐

FY 2017‐18 FY 2018‐19 FY 2019‐20 FY 2020‐21 FY 2020‐21 FY 2021‐22

Actual Actual Actual Budget YE Proj. Proposed

Budget

Sales Tax

Other Taxes (Franchise Fees & FY 2021-22 Budget $4,336,146

Mixed % of Fund Revenue 10.7 %

Beverage Tax):

Compared to $ Growth % Growth

FY 2020-21 Budget $(17,655) (0.4)%

FY 2020-21 Projection $60,641 1.4%

Other Taxes (Franchise Fees & Mixed Beverage Taxes) are comprised of mixed beverage and

franchise taxes, with the latter accounting for approximately 96.4% of these revenues. Franchise taxes

are fees charged for the continued use of public property (rights-of-way) and are collected from utility

companies, including the City of Keller's Water & Wastewater Utility, and Drainage Utility funds. Revenues

are based on trends that reflect decreasing cable franchise fees. Electric franchise fees have been

decreasing as rates continue to lower and telecommunications franchise fees have decreased as cable

subscriptions continue to decline. In 2019 the Texas Legislature passed SB 1152, which relates to the

payment of certain fees to municipalities by companies that provide telecommunications, cable or video

services. Declines in franchise fee revenue may be attributed to this legislation. Mixed beverage tax is

related to mixed alcohol beverage sales in restaurants and pubs within the city and is showing a slight

decline.

48