Page 49 - Microsoft Word - FY 2021 tax info sheet

P. 49

Ad Valorem Taxes:

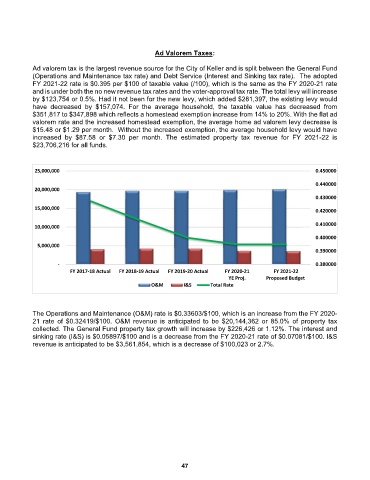

Ad valorem tax is the largest revenue source for the City of Keller and is split between the General Fund

(Operations and Maintenance tax rate) and Debt Service (Interest and Sinking tax rate). The adopted

FY 2021-22 rate is $0.395 per $100 of taxable value (/100), which is the same as the FY 2020-21 rate

and is under both the no new revenue tax rates and the voter-approval tax rate. The total levy will increase

by $123,754 or 0.5%. Had it not been for the new levy, which added $281,397, the existing levy would

have decreased by $157,074. For the average household, the taxable value has decreased from

$351,817 to $347,898 which reflects a homestead exemption increase from 14% to 20%. With the flat ad

valorem rate and the increased homestead exemption, the average home ad valorem levy decrease is

$15.48 or $1.29 per month. Without the increased exemption, the average household levy would have

increased by $87.58 or $7.30 per month. The estimated property tax revenue for FY 2021-22 is

$23,706,216 for all funds.

25,000,000 0.450000

0.440000

20,000,000

0.430000

15,000,000

0.420000

0.410000

10,000,000

0.400000

5,000,000

0.390000

‐ 0.380000

FY 2017‐18 Actual FY 2018‐19 Actual FY 2019‐20 Actual FY 2020‐21 FY 2021‐22

YE Proj. Proposed Budget

O&M I&S Total Rate

The Operations and Maintenance (O&M) rate is $0.33603/$100, which is an increase from the FY 2020-

21 rate of $0.32419/$100. O&M revenue is anticipated to be $20,144,362 or 85.0% of property tax

collected. The General Fund property tax growth will increase by $226,426 or 1.12%. The interest and

sinking rate (I&S) is $0.05897/$100 and is a decrease from the FY 2020-21 rate of $0.07081/$100. I&S

revenue is anticipated to be $3,561,854, which is a decrease of $100,023 or 2.7%.

47