Page 436 - Microsoft Word - FY 2021 tax info sheet

P. 436

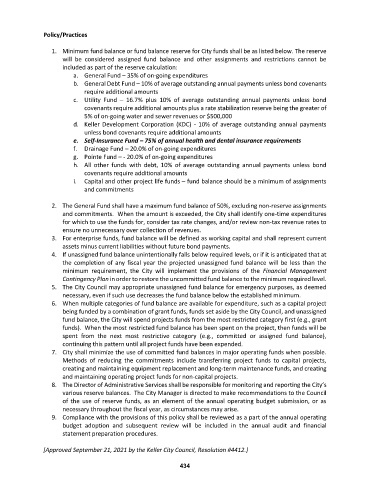

Policy/Practices

1. Minimum fund balance or fund balance reserve for City funds shall be as listed below. The reserve

will be considered assigned fund balance and other assignments and restrictions cannot be

included as part of the reserve calculation:

a. General Fund – 35% of on-going expenditures

b. General Debt Fund – 10% of average outstanding annual payments unless bond covenants

require additional amounts

c. Utility Fund – 16.7% plus 10% of average outstanding annual payments unless bond

covenants require additional amounts plus a rate stabilization reserve being the greater of

5% of on-going water and sewer revenues or $500,000

d. Keller Development Corporation (KDC) - 10% of average outstanding annual payments

unless bond covenants require additional amounts

e. Self-Insurance Fund – 75% of annual health and dental insurance requirements

f. Drainage Fund – 20.0% of on-going expenditures

g. Pointe Fund – - 20.0% of on-going expenditures

h. All other funds with debt, 10% of average outstanding annual payments unless bond

covenants require additional amounts

i. Capital and other project life funds – fund balance should be a minimum of assignments

and commitments

2. The General Fund shall have a maximum fund balance of 50%, excluding non-reserve assignments

and commitments. When the amount is exceeded, the City shall identify one-time expenditures

for which to use the funds for, consider tax rate changes, and/or review non-tax revenue rates to

ensure no unnecessary over collection of revenues.

3. For enterprise funds, fund balance will be defined as working capital and shall represent current

assets minus current liabilities without future bond payments.

4. If unassigned fund balance unintentionally falls below required levels, or if it is anticipated that at

the completion of any fiscal year the projected unassigned fund balance will be less than the

minimum requirement, the City will implement the provisions of the Financial Management

Contingency Plan in order to restore the uncommitted fund balance to the minimum required level.

5. The City Council may appropriate unassigned fund balance for emergency purposes, as deemed

necessary, even if such use decreases the fund balance below the established minimum.

6. When multiple categories of fund balance are available for expenditure, such as a capital project

being funded by a combination of grant funds, funds set aside by the City Council, and unassigned

fund balance, the City will spend projects funds from the most restricted category first (e.g., grant

funds). When the most restricted fund balance has been spent on the project, then funds will be

spent from the next most restrictive category (e.g., committed or assigned fund balance),

continuing this pattern until all project funds have been expended.

7. City shall minimize the use of committed fund balances in major operating funds when possible.

Methods of reducing the commitments include transferring project funds to capital projects,

creating and maintaining equipment replacement and long-term maintenance funds, and creating

and maintaining operating project funds for non-capital projects.

8. The Director of Administrative Services shall be responsible for monitoring and reporting the City’s

various reserve balances. The City Manager is directed to make recommendations to the Council

of the use of reserve funds, as an element of the annual operating budget submission, or as

necessary throughout the fiscal year, as circumstances may arise.

9. Compliance with the provisions of this policy shall be reviewed as a part of the annual operating

budget adoption and subsequent review will be included in the annual audit and financial

statement preparation procedures.

[Approved September 21, 2021 by the Keller City Council, Resolution #4412.]

434