Page 307 - Microsoft Word - FY 2021 tax info sheet

P. 307

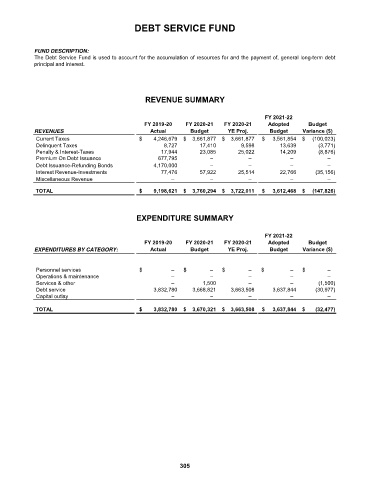

DEBT SERVICE FUND

FUND DESCRIPTION:

The Debt Service Fund is used to account for the accumulation of resources for and the payment of, general long-term debt

principal and interest.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Current Taxes $ 4,246,679 $ 3,661,877 $ 3,661,877 $ 3,561,854 $ (100,023)

Delinquent Taxes 8,727 17,410 9,598 13,639 (3,771)

Penalty & Interest-Taxes 17,944 23,085 25,022 14,209 (8,876)

Premium On Debt Issuance 677,795 – – – –

Debt Issuance-Refunding Bonds 4,170,000 – – – –

Interest Revenue-Investments 77,476 57,922 25,514 22,766 (35,156)

Miscellaneous Revenue – – – – –

TOTAL $ 9,198,621 $ 3,760,294 $ 3,722,011 $ 3,612,468 $ (147,826)

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance – – – – –

Services & other – 1,500 – – (1,500)

Debt service 3,832,780 3,668,821 3,663,508 3,637,844 (30,977)

Capital outlay – – – – –

TOTAL $ 3,832,780 $ 3,670,321 $ 3,663,508 $ 3,637,844 $ (32,477)

305