Page 297 - Microsoft Word - FY 2021 tax info sheet

P. 297

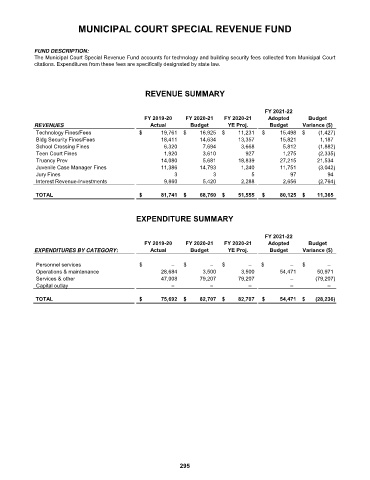

MUNICIPAL COURT SPECIAL REVENUE FUND

FUND DESCRIPTION:

The Municipal Court Special Revenue Fund accounts for technology and building security fees collected from Municipal Court

citations. Expenditures from these fees are specifically designated by state law.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

Technology Fines/Fees $ 19,761 $ 16,925 $ 11,231 $ 15,498 $ (1,427)

Bldg Security Fines/Fees 18,411 14,634 13,357 15,821 1,187

School Crossing Fines 6,320 7,694 3,668 5,812 (1,882)

Teen Court Fines 1,920 3,610 927 1,275 (2,335)

Truancy Prev 14,080 5,681 18,839 27,215 21,534

Juvenile Case Manager Fines 11,386 14,793 1,240 11,751 (3,042)

Jury Fines 3 3 5 97 94

Interest Revenue-Investments 9,860 5,420 2,288 2,656 (2,764)

TOTAL $ 81,741 $ 68,760 $ 51,555 $ 80,125 $ 11,365

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Personnel services $ – $ – $ – $ – $ –

Operations & maintenance 28,684 3,500 3,500 54,471 50,971

Services & other 47,008 79,207 79,207 – (79,207)

Capital outlay – – – – –

TOTAL $ 75,692 $ 82,707 $ 82,707 $ 54,471 $ (28,236)

295