Page 291 - Microsoft Word - FY 2021 tax info sheet

P. 291

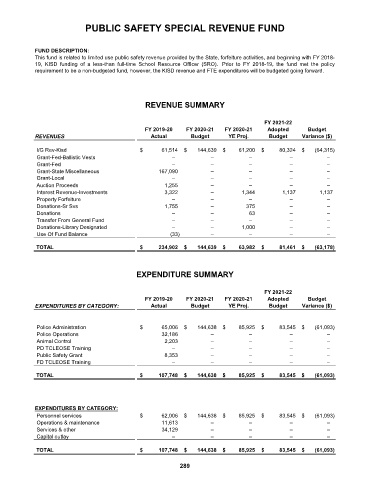

PUBLIC SAFETY SPECIAL REVENUE FUND

FUND DESCRIPTION:

This fund is related to limited use public safety revenue provided by the State, forfeiture activities, and beginning with FY 2018-

19, KISD funding of a less-than full-time School Resource Officer (SRO). Prior to FY 2018-19, the fund met the policy

requirement to be a non-budgeted fund, however, the KISD revenue and FTE expenditures will be budgeted going forward.

REVENUE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

REVENUES Actual Budget YE Proj. Budget Variance ($)

I/G Rev-Kisd $ 61,514 $ 144,639 $ 61,200 $ 80,324 $ (64,315)

Grant-Fed-Ballistic Vests – – – – –

Grant-Fed – – – – –

Grant-State Miscellaneous 167,090 – – – –

Grant-Local – – – – –

Auction Proceeds 1,255 – – – –

Interest Revenue-Investments 3,322 – 1,344 1,137 1,137

Property Forfeiture – – – – –

Donations-Sr Svs 1,755 – 375 – –

Donations – – 63 – –

Transfer From General Fund – – – – –

Donations-Library Designated – – 1,000 – –

Use Of Fund Balance (33) – – – –

TOTAL $ 234,902 $ 144,639 $ 63,982 $ 81,461 $ (63,178)

EXPENDITURE SUMMARY

FY 2021-22

FY 2019-20 FY 2020-21 FY 2020-21 Adopted Budget

EXPENDITURES BY CATEGORY: Actual Budget YE Proj. Budget Variance ($)

Police Administration $ 65,006 $ 144,638 $ 85,925 $ 83,545 $ (61,093)

Police Operations 32,186 – – – –

Animal Control 2,203 – – – –

PD TCLEOSE Training – – – – –

Public Safety Grant 8,353 – – – –

FD TCLEOSE Training – – – – –

TOTAL $ 107,748 $ 144,638 $ 85,925 $ 83,545 $ (61,093)

EXPENDITURES BY CATEGORY:

Personnel services $ 62,006 $ 144,638 $ 85,925 $ 83,545 $ (61,093)

Operations & maintenance 11,613 – – – –

Services & other 34,129 – – – –

Capital outlay – – – – –

TOTAL $ 107,748 $ 144,638 $ 85,925 $ 83,545 $ (61,093)

289