Page 340 - Hurst Adopted FY22 Budget

P. 340

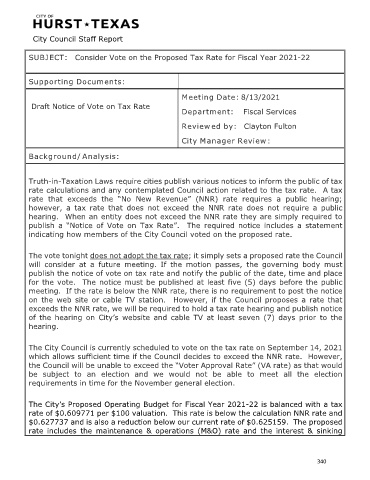

City Council Staff Report

SUBJECT: Consider Vote on the Proposed Tax Rate for Fiscal Year 2021-22

Supporting Documents:

Meeting Date: 8/13/2021

Draft Notice of Vote on Tax Rate

Department: Fiscal Services

Reviewed by: Clayton Fulton

City Manager Review:

Background/Analysis:

Truth-in-Taxation Laws require cities publish various notices to inform the public of tax

rate calculations and any contemplated Council action related to the tax rate. A tax

rate that exceeds the “No New Revenue” (NNR) rate requires a public hearing;

however, a tax rate that does not exceed the NNR rate does not require a public

hearing. When an entity does not exceed the NNR rate they are simply required to

publish a “Notice of Vote on Tax Rate”. The required notice includes a statement

indicating how members of the City Council voted on the proposed rate.

The vote tonight does not adopt the tax rate; it simply sets a proposed rate the Council

will consider at a future meeting. If the motion passes, the governing body must

publish the notice of vote on tax rate and notify the public of the date, time and place

for the vote. The notice must be published at least five (5) days before the public

meeting. If the rate is below the NNR rate, there is no requirement to post the notice

on the web site or cable TV station. However, if the Council proposes a rate that

exceeds the NNR rate, we will be required to hold a tax rate hearing and publish notice

of the hearing on City’s website and cable TV at least seven (7) days prior to the

hearing.

The City Council is currently scheduled to vote on the tax rate on September 14, 2021

which allows sufficient time if the Council decides to exceed the NNR rate. However,

the Council will be unable to exceed the “Voter Approval Rate” (VA rate) as that would

be subject to an election and we would not be able to meet all the election

requirements in time for the November general election.

The City’s Proposed Operating Budget for Fiscal Year 2021-22 is balanced with a tax

rate of $0.609771 per $100 valuation. This rate is below the calculation NNR rate and

$0.627737 and is also a reduction below our current rate of $0.625159. The proposed

rate includes the maintenance & operations (M&O) rate and the interest & sinking

340