Page 334 - Hurst Adopted FY22 Budget

P. 334

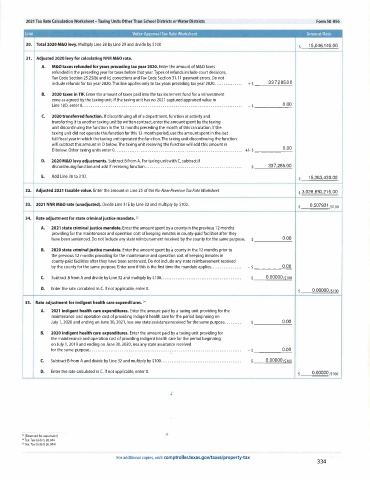

2021 Tax Rate Calculation Worksheet -Taxing Units Other Than School Districts or Water Districts FormS0-856

30. Total 2020 M&O levy. Multiply Line 28 by Line 29 and divide by $100 15 ,046, 145.00

31. Adjusted 2020 levy for calculating NNR M&O rate.

A. M&O taxes refunded for years preceding tax year 2020. Enter the amount of M&O taxes

refunded in the preceding year for taxes before that year. Types of refunds include court decisions,

Tax Code Section 25.25(b) and (c) corrections and Tax Code Section 31.11 payment errors. Do not

include refunds for tax year 2020. This line applies only to tax years preceding tax year 2020. . . . . . . . . . . . . . . + $ ___ 3_3_7_, 2_ 8 _ 5 _.O_ O _

8. 2020 taxes in TIF. Enter the amount of taxes paid into the tax increment fund for a reinvestment

zone as agreed by the taxing unit. If the taxing unit has no 2021 captured appraised value in

Line 18D, enter 0....................................................................................... - $ _ ___ _ 0._0 _ 0

C. 2020 transferred function. If discontinuing all of a department, function or activity and

transferring it to another taxing unit by written contract, enter the amount spent by the taxing

unit discontinuing the function in the 12 months preceding the month of this calculation. If the

taxing unit did not operate this function for this 12-month period, use the amount spent in the last

full fiscal year in which the taxing unit operated the function. The taxing unit discontinuing the function

will subtract this amount in D below. The taxing unit receiving the function will add this amount in

D below. Other taxing units enter 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . +/- $ _____ O.OO

_ _

D. 2020 M&O levy adjustments. Subtract B from A. For taxing unit with C, subtract if

discontinuing function and add if receiving function .................................................... . 337,2 85.00

E. Add Line 30 to 31 D. 15 , 3 8 3 ,4 3 0 . 00

32. Adjusted 2021 taxable value. Enter the amount in Line 25 of the No-New-Revenue Tax Rate Worksheet. $ 3,02 8,650,2 15.00

E

33. 2021 NNR M&O rate (unadjusted). Divide Line 31 b y Line 32 and multiply by $100. 0.507931 /$100

34. Rate adjustment for state criminal justice mandate. 23

A. 2021 state criminal justice mandate. Enter the amount spent by a county in the previous 12 months

providing for the maintenance and operation cost of keeping inmates in county-paid facilities after they

have been sentenced. Do not include any state reimbursement received by the county for the same purpose. 0.00

8. 2020 state criminal justice mandate. Enter the amount spent by 'a county in the 12 months prior to

the previous 12 months providing for the maintenance and operation cost of keeping inmates in

county-paid facilities after they have been sentenced. Do not include any state reimbursement received

by the county for the same purpose. Enter zero if this is the first time the mandate applies................. - $ ______ 0_ .0 _ 0_

C. Subtract B from A and divide by Line 32 and multiply by $100 ........................................... . o.OO0OO1s100

D. Enter the rate calculated in C. If not applicable, enter 0. 0.00000/$100

3S. Rate adjustment for indigent health care expenditures. 24

A. 2021 indigent health care expenditures. Enter the amount paid by a taxing unit providing for the

maintenance and operation cost of providing indigent health care for the period beginning on

July 1, 2020 and ending on June 30, 2021, less any state assistance received for the same purpose . ...... . 0.00

.

8. 2020 indigent health care expenditures. Enter the amount paid by a taxing unit providing for

the maintenance and operation cost of providing indigent health care for the period beginning

on July 1, 2019 and ending on June 30, 2020, less any state assistance received

·

for the same purpose .. .......................................... ;..................................... - $ ______ 0_ .0 _ 0_

C. Subtract B from A and divide by Line 32 and multiply by $100 ........................................... . o.OO0OO1s100

D. Enter the rate calculated in C. If not applicable, enter 0. 0.00000 /$100

22 [Reserved for expansion]

23 Tex. Tax Code§ 26.044

"Tex. Tax Code § 26.0441

For additional copies, visit: comptroller.texas.gov/taxes/property-tax

334