Page 61 - Grapevine FY22 Adopted Budget v2

P. 61

Key Expenditure Drivers and Assumptions

Personnel costs are based upon the assumption of full employment, with no addition of

permanent personnel during the next three years.

The COVID-19 pandemic halted citywide merit and market compensation increases in FY20.

Then, in mid-year FY21, Council approved a 2% market increase for all full-time employees

which was shortly followed with a budgeted FY22 2% merit increase for general employees and

a two-step increase for public safety employees. Over the next three years, personnel costs are

expected to rise 2-5% each year.

Supplies, Maintenance, and Services are projected to increase at a rate of 3-5% per year due to

record inflation. Costs for supplies dropped 8% during the COVID-19 pandemic due to

reductions in service levels. However, supply costs are expected to reach pre-pandemic levels in

FY22. Maintenance costs in FY22 are expected to be 28% greater than FY20 and 5% greater

than FY21. Service costs fell 14% in FY21 due to reduced services levels during the first half of

the year. FY22 service costs are expected to rise 8% over FY21.

Capital / Street Maintenance costs are derived from the five-year plan submitted by the

facilities, parks maintenance, streets and traffic divisions. The plan consists of a detailed

program of activities for each piece of capital infrastructure within the city.

Insurance costs include property and casualty coverage as well as employee medical, dental,

vision and life insurance coverage which increased 34% between FY19 and FY20. After slight

reductions to costs in FY21, the FY22 budget allocates an additional 14% over FY21.

Debt Service costs will vary, as it is dependent upon several factors. As debt has been

restructured to take advantage of lower interest rates, the amount of property tax required to

support debt obligations (the I&S portion of the tax rate) will fall correspondingly as existing

debt is paid off. As the I&S portion of the debt rate decreases, the ability to generate additional

revenue for the General fund (the M&O portion of the tax rate) is limited due to rollback

provisions. In an attempt to maintain the tax rate at the current level of $0.271811 or the No

New Revenue Rate, some financial considerations must be made.

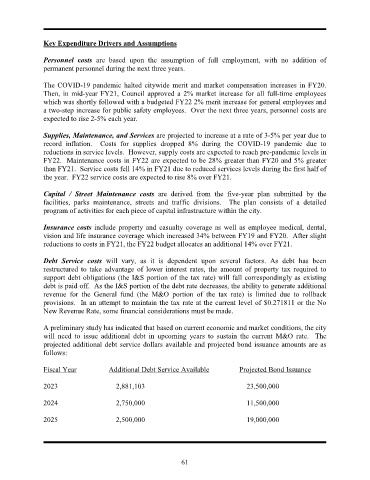

A preliminary study has indicated that based on current economic and market conditions, the city

will need to issue additional debt in upcoming years to sustain the current M&O rate. The

projected additional debt service dollars available and projected bond issuance amounts are as

follows:

Fiscal Year Additional Debt Service Available Projected Bond Issuance

2023 2,881,103 23,500,000

2024 2,750,000 11,500,000

2025 2,500,000 19,000,000

61