Page 57 - Grapevine FY22 Adopted Budget v2

P. 57

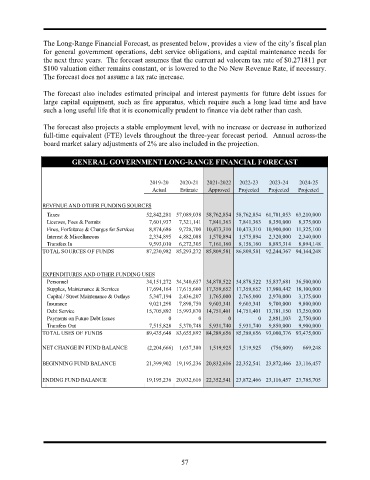

The Long-Range Financial Forecast, as presented below, provides a view of the city’s fiscal plan

for general government operations, debt service obligations, and capital maintenance needs for

the next three years. The forecast assumes that the current ad valorem tax rate of $0.271811 per

$100 valuation either remains constant, or is lowered to the No New Revenue Rate, if necessary.

The forecast does not assume a tax rate increase.

The forecast also includes estimated principal and interest payments for future debt issues for

large capital equipment, such as fire apparatus, which require such a long lead time and have

such a long useful life that it is economically prudent to finance via debt rather than cash.

The forecast also projects a stable employment level, with no increase or decrease in authorized

full-time equivalent (FTE) levels throughout the three-year forecast period. Annual across-the

board market salary adjustments of 2% are also included in the projection.

GENERAL GOVERNMENT LONG-RANGE FINANCIAL FORECAST

2019-20 2020-21 2021-2022 2022-23 2023-24 2024-25

Actual Estimate Approved Projected Projected Projected

REVENUE AND OTHER FUNDING SOURCES

Taxes 52,842,281 57,089,038 58,762,854 58,762,854 61,781,053 63,210,000

Licenses, Fees & Permits 7,601,937 7,321,141 7,841,363 7,841,363 8,350,000 8,375,000

Fines, Forfeitures & Charges for Services 8,874,686 9,728,700 10,473,310 10,473,310 10,900,000 11,325,100

Interest & Miscellaneous 2,334,895 4,882,088 1,570,894 1,575,894 2,320,000 2,340,000

Transfers In 9,593,010 6,272,305 7,161,160 8,156,160 8,893,314 8,894,148

TOTAL SOURCES OF FUNDS 87,230,982 85,293,272 85,809,581 86,809,581 92,244,367 94,144,248

EXPENDITURES AND OTHER FUNDING USES

Personnel 34,151,272 34,340,657 34,878,522 34,878,522 35,837,681 36,500,000

Supplies, Maintenance & Services 17,694,164 17,615,660 17,359,652 17,359,652 17,980,442 18,100,000

Capital / Street Maintenance & Outlays 5,347,194 2,436,207 1,765,000 2,765,000 2,970,000 3,175,000

Insurance 9,021,298 7,898,750 9,603,341 9,603,341 9,700,000 9,800,000

Debt Service 15,705,892 15,993,870 14,751,401 14,751,401 13,781,150 13,250,000

Payments on Future Debt Issues 0 0 0 0 2,881,103 2,750,000

Transfers Out 7,515,828 5,370,748 5,931,740 5,931,740 9,850,000 9,900,000

TOTAL USES OF FUNDS 89,435,648 83,655,892 84,289,656 85,289,656 93,000,376 93,475,000

NET CHANGE IN FUND BALANCE (2,204,666) 1,637,380 1,519,925 1,519,925 (756,009) 669,248

BEGINNING FUND BALANCE 21,399,902 19,195,236 20,832,616 22,352,541 23,872,466 23,116,457

ENDING FUND BALANCE 19,195,236 20,832,616 22,352,541 23,872,466 23,116,457 23,785,705

57