Page 90 - FortWorthFY22AdoptedBudget

P. 90

General Fund

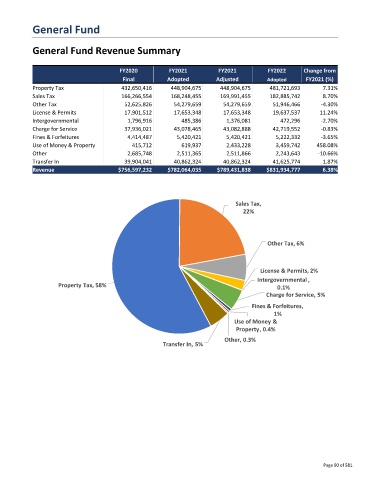

General Fund Revenue Summary

FY2020 FY2021 FY2021 FY2022 Change from

Final Adopted Adjusted Adopted FY2021 (%)

Property Tax 432,650,416 448,904,675 448,904,675 481,721,693 7.31%

Sales Tax 166,266,554 168,248,455 169,991,455 182,885,742 8.70%

Other Tax 52,625,826 54,279,659 54,279,659 51,946,466 -4.30%

License & Permits 17,901,512 17,653,348 17,653,348 19,637,537 11.24%

Intergovernmental 1,796,916 485,386 1,376,081 472,296 -2.70%

Charge for Service 37,936,021 43,078,465 43,082,888 42,719,552 -0.83%

Fines & Forfeitures 4,414,487 5,420,421 5,420,421 5,222,332 -3.65%

Use of Money & Property 415,712 619,937 2,433,228 3,459,742 458.08%

Other 2,685,748 2,511,365 2,511,866 2,243,643 -10.66%

Transfer In 39,904,041 40,862,324 40,862,324 41,625,774 1.87%

Revenue $756,597,232 $782,064,035 $789,431,838 $831,934,777 6.38%

Sales Tax,

22%

Other Tax, 6%

License & Permits, 2%

Intergovernmental ,

Property Tax, 58% 0.1%

Charge for Service, 5%

Fines & Forfeitures,

1%

Use of Money &

Property, 0.4%

Other, 0.3%

Transfer In, 5%

Page 90 of 581