Page 106 - Forest Hill FY22 Annual Budget

P. 106

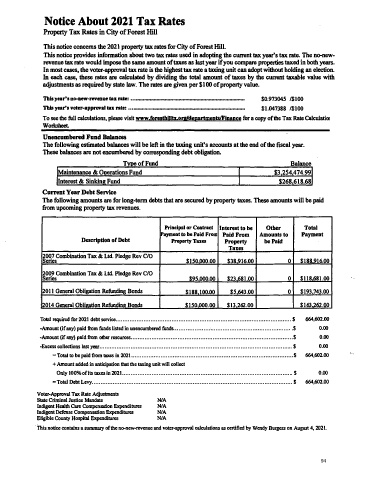

Notice About 2021 Tax Rates

Property Tax Rates in City of Forest Hill

This notice concerns the 2021 propert tax rates for City of Forest Hill.

This notice provides informaton about two tax rate used in adopting the current tax year's tax rate. The no-new

revenue tax rate would impose the same amount of taxe as last year if you compare propertes taxed in both years.

In most cases, the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election.

In each case, these rate are calculated by dividing the total amount of taxes by the current taxale value with

adjustments as required by state law. The rates are given per $100 of property value.

This year's no-new-revenue tas nte: ................................................................................. . $0.97304S /$100

Tb.i year's voter-apprOYal tax nte: •••• " ......... " .................................................................. . $1.047388 /$100

To see the full calculations, please visit www.forestbWtLon/departments/Finance for a copy of the Tax Rate Calculatio1

Worksheet.

Unencumbered Fund Balances

The following estimated balances will be left in the taxing unit's accounts at the end of the fiscal year.

These balances are not encumbere by corresponding debt obligation.

T voeo fF d un Bal ance

Maintenance & Onerations Fund $3.254.474.99

Interest & Sinkin2 Fund $268.618.68

Current Year Debt Service

The following amounts are for long-term debts that are secured by property taxes. These amounts will be paid

from upcoming property tax revenues.

Principal or Contract Interest to be Other Total

Payment to be Paid From Paid From Amounts to Payment

Description of Debt Property Taxes Property be Paid

Taxes

2007 Combination Tax & Ltd. Pledge Rev C/0

Series $150.000.00 $38.916.00 0 $ 188.916.00

2009 Combination Tax & Ltd. Pledge Rev C/0

Series $9S.000.00 $23.681.00 0 $118.681.00

2011 General Obligation Refunding Bonds $188.100.00 $5.643.00 0 $193.743.00

2014 General Obliaation Refundin2 Bonds $150.000.00 $13.262.00 $163.262.00

Total require for 2021 debt service ..................................................................................................... $ 664,602.00

-Amount (if any) paid from funds listed in unencumbered funds .................... .-•..............•.....................•.......•. $ 0.00

-Amount (if any) paid from othe resource ••••••••••.••••••••••••••••••.••••••••••••••••..•••••••••••••••••...•.•••••••••••••.••••••••• $ 0.00

-Excess collections last year ............................................................................................................... $ 0.00

= Total to be paid ftom taxe in 2021 ............................................................................................. S 664,602.00

+ Amount added in anticipation that the taxing unit will collect

Only 100%of its taxes in 2021 .................................................................................................. S 0.00

= Total Debt Levy ................................................................................................................... S 664,602.00

Voter-Approval Tax Rate Adjustments

State Criminal Justice Mandate N/A

Indigent Health Care Compenon Expediture NIA

Indigent Defe Compensaon Expediture NIA

Eligible County Hospital Expenditure N/ A

· This notice contains a summary of the no-new-revenue and voter-approval calculations as certified by Wendy Burgess on August 4, 2021.

94