Page 105 - Forest Hill FY22 Annual Budget

P. 105

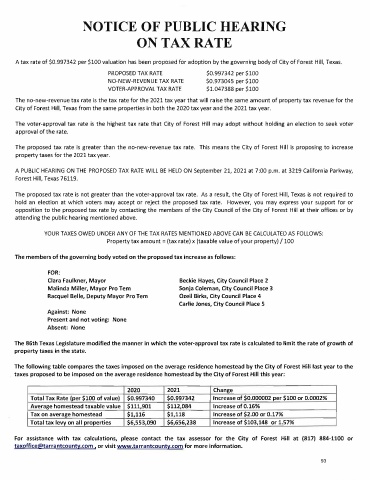

NOTICE OF PUBLIC HEARING

ON TAX RATE

A tax rate of $0.997342 per $100 valuation has been proposed for adoption by the governing body of City of Forest Hill, Texas.

PROPOSED TAX RATE $0.997342 per $100

NO-NEW-REVENUE TAX RATE $0.973045 per $100

VOTER-APPROVAL TAX RATE $1.047388 per $100

The no-new-revenue tax rate is the tax rate for the 2021 tax year that will raise the same amount of property tax revenue for the

City of Forest Hill, Texas from the same properties in both the 2020 tax year and the 2021 tax year.

The voter-approval tax rate is the highest tax rate that City of Forest Hill may adopt without holding an election to seek voter

approval of the rate.

The proposed tax rate is greater than the no-new-revenue tax rate. This means the City of Forest Hill is proposing to increase

property taxes for the 2021 tax year.

A PUBLIC HEARING ON THE PROPOSED TAX RATE WILL BE HELD ON September 21, 2021 at 7:00 p.m. at 3219 California Parkway,

Forest Hill, Texas 76119.

The proposed tax rate is not greater than the voter-approval tax rate. As a result, the City of Forest Hill, Texas is not required to

hold an election at which voters may accept or reject the proposed tax rate. However, you may express your support for or

opposition to the proposed tax rate by contacting the members of the City Council of the City of Forest Hill at their offices or by

attending the public hearing mentioned above.

YOUR TAXES OWED UNDER ANY OF THE TAX RATES MENTIONED ABOVE CAN BE CALCULATED AS FOLLOWS:

Property tax amount= (tax rate) x (taxable value of your property)/ 100

The members of the governing body voted on the proposed tax increase as follows:

FOR:

Clara Faulkner, Mayor Beckie Hayes, City Council Place 2

Malinda Miller, Mayor Pro Tern Sonja Coleman, City Council Place 3

Racquel Belle, Deputy Mayor Pro Tern Ozell Birks, City Council Place 4

Carlie Jones, City Council Place 5

Against: None

Present and not voting: None

Absent: None

The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of

property taxes in the state.

The following table compares the taxes imposed on the average residence homestead by the City of Forest Hill last year to the

taxes proposed to be imposed on the average residence homestead by the City of Forest Hill this year:

2020 2021 Change

Total Tax Rate (per $100 of value) $0.997340 $0.997342 Increase of $0.000002 per $100 or 0.0002%

Average homestead taxable value $111,901 $112,084 Increase of 0.16%

Tax on average homestead $1,116 $1,118 Increase of $2.00 or 0.17%

Total tax levy on all properties $6,553,090 $6,656,238 Increase of $103,148 or 1.57%

For assistance with tax calculations, please contact the tax assessor for the City of Forest Hill at (817) 884-1100 or

taxoffice@tarrantcounty.com • or visit www.tarrantcounty.com for more information.

93