Page 10 - City of Colleyville FY22 Adopted Budget

P. 10

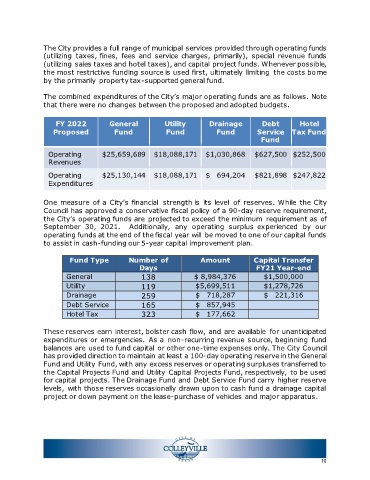

The City provides a full range of municipal services provided through operating funds

(utilizing taxes, fines, fees and service charges, primarily), special revenue funds

(utilizing sales taxes and hotel taxes), and capital project funds. Whenever possible,

the most restrictive funding source is used first, ultimately limiting the costs borne

by the primarily property tax-supported general fund.

The combined expenditures of the City’s major operating funds are as follows. Note

that there were no changes between the proposed and adopted budgets.

FY 2022 General Utility Drainage Debt Hotel

Proposed Fund Fund Fund Service Tax Fund

Fund

Operating $25,659,689 $18,088,171 $1,030,868 $627,500 $252,500

Revenues

Operating $25,130,144 $18,088,171 $ 694,204 $821,898 $247,822

Expenditures

One measure of a City’s financial strength is its level of reserves. While the City

Council has approved a conservative fiscal policy of a 90-day reserve requirement,

the City’s operating funds are projected to exceed the minimum requirement as of

September 30, 2021. Additionally, any operating surplus experienced by our

operating funds at the end of the fiscal year will be moved to one of our capital funds

to assist in cash-funding our 5-year capital improvement plan.

Fund Type Number of Amount Capital Transfer

Days FY21 Year-end

General 138 $ 8,984,376 $1,500,000

Utility 119 $5,699,511 $1,278,726

Drainage 259 $ 718,287 $ 221,316

Debt Service 165 $ 857,945

Hotel Tax 323 $ 177,662

These reserves earn interest, bolster cash flow, and are available for unanticipated

expenditures or emergencies. As a non-recurring revenue source, beginning fund

balances are used to fund capital or other one-time expenses only. The City Council

has provided direction to maintain at least a 100-day operating reserve in the General

Fund and Utility Fund, with any excess reserves or operating surpluses transferred to

the Capital Projects Fund and Utility Capital Projects Fund, respectively, to be used

for capital projects. The Drainage Fund and Debt Service Fund carry higher reserve

levels, with those reserves occasionally drawn upon to cash fund a drainage capital

project or down payment on the lease-purchase of vehicles and major apparatus.

10