Page 136 - Burleson FY22 City Budget

P. 136

projects;possibly slower completion

of projects; current users paying to

Higher interest and issuance cost;

than revenue bonds;requires time

High interest and issuance costs;

Issuance costs higher than short

term type of financing, but lower

and expense for voter approval.

Not normally feasible for larger

evidence of public support not

evidence of public support not

restrictive covenants involved;

restrictive covenants involved;

benefit future users.

Negative Points

obtained.

obtained.

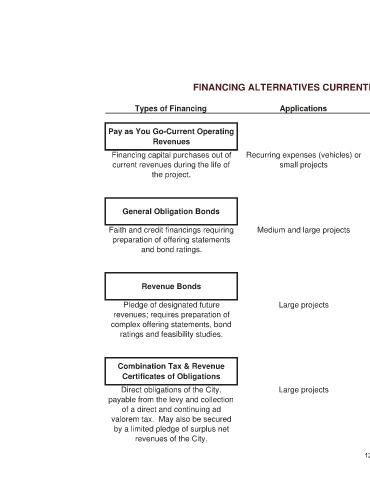

FINANCING ALTERNATIVES CURRENTLY IN USE BY THE CITY OF BURLESON

demands on management's time and

No interest or issuance costs; lesser

Not faith and credit pledged; voter

Not faith and credit pledged; voter

shorter time period necessary to

involved;requires voter approval

terms;no restrictive covenants

Lowest interest rate, flexible

confirmingpublic support.

approval not required.

approval not required.

Positive Points

projects

initiate

125

Applications Recurring expenses (vehicles) or small projects Medium and large projects Large projects Large projects

Types of Financing

Revenues Pay as You Go-Current Operating Financing capital purchases out of current revenues during the life of the project. General Obligation Bonds Faith and credit financings requiring preparation of offering statements and bond ratings. Revenue Bonds Pledge of designated future revenues; requires preparation of complex offering statements, bond ratings and feasibility studies. Combination Tax & Revenue Certificates of Obligations Direct obligations of the City, payable from the levy and collection of a direct and continuing ad valorem tax. May also be secured by a limited pledge of surplus net revenues of the City.