Page 325 - FY 2021-22 ADOPTED BUDGET

P. 325

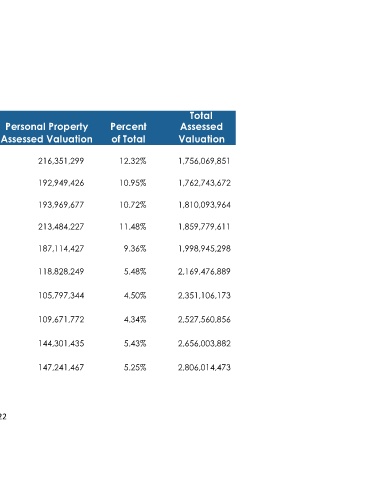

TEN YEAR SUMMARY OF ASSESSED VALUATIONS

ACTUAL AND ESTIMATED

FY 2012-13 TO 2021-22

Total

Fiscal Real Property Percent Personal Property Percent Assessed

Year Assessed Valuation of Total Assessed Valuation of Total Valuation

2012-13 1,469,801,926 83.70% 216,351,299 12.32% 1,756,069,851

2013-14 1,493,199,486 84.71% 192,949,426 10.95% 1,762,743,672

2014-15 1,616,124,287 89.28% 193,969,677 10.72% 1,810,093,964

2015-16 1,646,295,384 88.52% 213,484,227 11.48% 1,859,779,611

2016-17 1,811,830,871 90.64% 187,114,427 9.36% 1,998,945,298

2017-18 2,050,648,640 94.52% 118,828,249 5.48% 2,169,476,889

2018-19 2,245,308,829 95.50% 105,797,344 4.50% 2,351,106,173

2019-20 2,417,889,084 95.66% 109,671,772 4.34% 2,527,560,856

2020-21 2,511,702,447 94.57% 144,301,435 5.43% 2,656,003,882

2021-22 2,658,773,006 94.75% 147,241,467 5.25% 2,806,014,473

222