Page 344 - Watauga FY21 Budget

P. 344

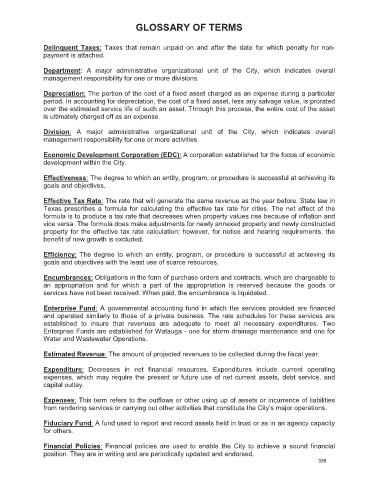

GLOSSARY OF TERMS

Delinquent Taxes: Taxes that remain unpaid on and after the date for which penalty for non-

payment is attached.

Department: A major administrative organizational unit of the City, which indicates overall

management responsibility for one or more divisions.

Depreciation: The portion of the cost of a fixed asset charged as an expense during a particular

period. In accounting for depreciation, the cost of a fixed asset, less any salvage value, is prorated

over the estimated service life of such an asset. Through this process, the entire cost of the asset

is ultimately charged off as an expense.

Division: A major administrative organizational unit of the City, which indicates overall

management responsibility for one or more activities.

Economic Development Corporation (EDC): A corporation established for the focus of economic

development within the City.

Effectiveness: The degree to which an entity, program, or procedure is successful at achieving its

goals and objectives.

Effective Tax Rate: The rate that will generate the same revenue as the year before. State law in

Texas prescribes a formula for calculating the effective tax rate for cities. The net effect of the

formula is to produce a tax rate that decreases when property values rise because of inflation and

vice versa. The formula does make adjustments for newly annexed property and newly constructed

property for the effective tax rate calculation; however, for notice and hearing requirements, the

benefit of new growth is excluded.

Efficiency: The degree to which an entity, program, or procedure is successful at achieving its

goals and objectives with the least use of scarce resources.

Encumbrances: Obligations in the form of purchase orders and contracts, which are chargeable to

an appropriation and for which a part of the appropriation is reserved because the goods or

services have not been received. When paid, the encumbrance is liquidated.

Enterprise Fund: A governmental accounting fund in which the services provided are financed

and operated similarly to those of a private business. The rate schedules for these services are

established to insure that revenues are adequate to meet all necessary expenditures. Two

Enterprise Funds are established for Watauga - one for storm drainage maintenance and one for

Water and Wastewater Operations.

Estimated Revenue: The amount of projected revenues to be collected during the fiscal year.

Expenditure: Decreases in net financial resources. Expenditures include current operating

expenses, which may require the present or future use of net current assets, debt service, and

capital outlay.

Expenses: This term refers to the outflows or other using up of assets or incurrence of liabilities

from rendering services or carrying out other activities that constitute the City’s major operations.

Fiduciary Fund: A fund used to report and record assets held in trust or as in an agency capacity

for others.

Financial Policies: Financial policies are used to enable the City to achieve a sound financial

position. They are in writing and are periodically updated and endorsed.

336