Page 343 - Watauga FY21 Budget

P. 343

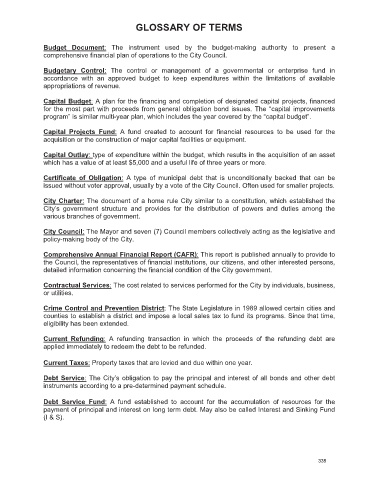

GLOSSARY OF TERMS

Budget Document: The instrument used by the budget-making authority to present a

comprehensive financial plan of operations to the City Council.

Budgetary Control: The control or management of a governmental or enterprise fund in

accordance with an approved budget to keep expenditures within the limitations of available

appropriations of revenue.

Capital Budget: A plan for the financing and completion of designated capital projects, financed

for the most part with proceeds from general obligation bond issues. The “capital improvements

program” is similar multi-year plan, which includes the year covered by the “capital budget”.

Capital Projects Fund: A fund created to account for financial resources to be used for the

acquisition or the construction of major capital facilities or equipment.

Capital Outlay: type of expenditure within the budget, which results in the acquisition of an asset

which has a value of at least $5,000 and a useful life of three years or more.

Certificate of Obligation: A type of municipal debt that is unconditionally backed that can be

issued without voter approval, usually by a vote of the City Council. Often used for smaller projects.

City Charter: The document of a home rule City similar to a constitution, which established the

City’s government structure and provides for the distribution of powers and duties among the

various branches of government.

City Council: The Mayor and seven (7) Council members collectively acting as the legislative and

policy-making body of the City.

Comprehensive Annual Financial Report (CAFR): This report is published annually to provide to

the Council, the representatives of financial institutions, our citizens, and other interested persons,

detailed information concerning the financial condition of the City government.

Contractual Services: The cost related to services performed for the City by individuals, business,

or utilities.

Crime Control and Prevention District: The State Legislature in 1989 allowed certain cities and

counties to establish a district and impose a local sales tax to fund its programs. Since that time,

eligibility has been extended.

Current Refunding: A refunding transaction in which the proceeds of the refunding debt are

applied immediately to redeem the debt to be refunded.

Current Taxes: Property taxes that are levied and due within one year.

Debt Service: The City’s obligation to pay the principal and interest of all bonds and other debt

instruments according to a pre-determined payment schedule.

Debt Service Fund: A fund established to account for the accumulation of resources for the

payment of principal and interest on long term debt. May also be called Interest and Sinking Fund

(I & S).

335