Page 60 - Saginaw FY21 Annual Budget

P. 60

CITY OF SAGINAW

GENERAL FUND SALES TAX REVENUE

2020-2021

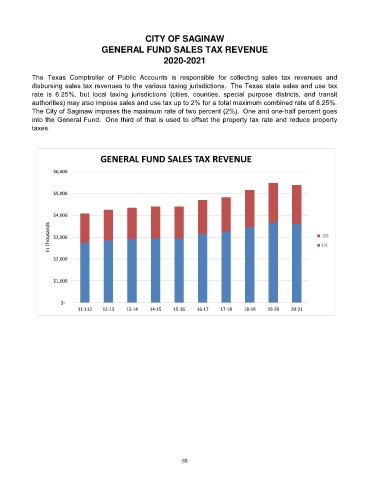

The Texas Comptroller of Public Accounts is responsible for collecting sales tax revenues and

disbursing sales tax revenues to the various taxing jurisdictions. The Texas state sales and use tax

rate is 6.25%, but local taxing jurisdictions (cities, counties, special purpose districts, and transit

authorities) may also impose sales and use tax up to 2% for a total maximum combined rate of 8.25%.

The City of Saginaw imposes the maximum rate of two percent (2%). One and one-half percent goes

into the General Fund. One third of that is used to offset the property tax rate and reduce property

taxes.

GENERAL FUND SALES TAX REVENUE

$6,000

$5,000

$4,000

.5%

In Thousands $3,000 .5%

1%

$2,000

$1,000

$-

11-112 12-13 13-14 14-15 15-16 16-17 17-18 18-19 19-20 20-21

60