Page 90 - Pantego Adopted Budget FY21

P. 90

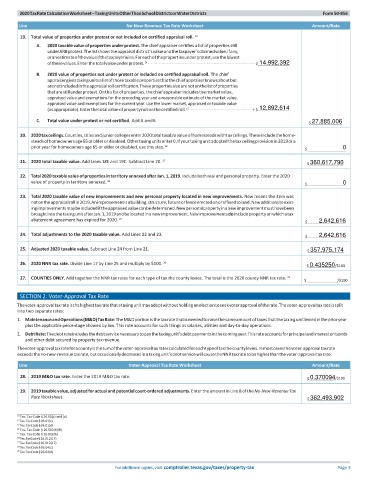

2020 Tax Rate Calculation Worksheet – Taxing Units Other Than School Districts or Water Districts Form 50-856

Line No-New-Revenue Tax Rate Worksheet Amount/Rate

19. Total value of properties under protest or not included on certified appraisal roll. 13

A. 2020 taxable value of properties under protest. The chief appraiser certifies a list of properties still

under ARB protest. The list shows the appraisal district’s value and the taxpayer’s claimed value, if any,

or an estimate of the value if the taxpayer wins. For each of the properties under protest, use the lowest

of these values. Enter the total value under protest. 14 .................................................................................................................................................... $ 14,992,392

B. 2020 value of properties not under protest or included on certified appraisal roll. The chief

appraiser gives taxing units a list of those taxable properties that the chief appraiser knows about but

are not included in the appraisal roll certification. These properties also are not on the list of properties

that are still under protest. On this list of properties, the chief appraiser includes the market value,

appraised value and exemptions for the preceding year and a reasonable estimate of the market value,

appraised value and exemptions for the current year. Use the lower market, appraised or taxable value

(as appropriate). Enter the total value of property not on the certified roll. 15 ...................................................................................... + $ 12,892,614

C. Total value under protest or not certified. Add A and B. $ 27,885,006

20. 2020 tax ceilings. Counties, cities and junior colleges enter 2020 total taxable value of homesteads with tax ceilings. These include the home-

steads of homeowners age 65 or older or disabled. Other taxing units enter 0. If your taxing unit adopted the tax ceiling provision in 2019 or a

prior year for homeowners age 65 or older or disabled, use this step. 16 0

$

21. 2020 total taxable value. Add Lines 18E and 19C. Subtract Line 20. 17 $ 360,617,790

22. Total 2020 taxable value of properties in territory annexed after Jan. 1, 2019. Include both real and personal property. Enter the 2020

18 0

value of property in territory annexed. $

23. Total 2020 taxable value of new improvements and new personal property located in new improvements. New means the item was

not on the appraisal roll in 2019. An improvement is a building, structure, fixture or fence erected on or affixed to land. New additions to exist-

ing improvements may be included if the appraised value can be determined. New personal property in a new improvement must have been

brought into the taxing unit after Jan. 1, 2019 and be located in a new improvement. New improvements do include property on which a tax

19 2,642,616

abatement agreement has expired for 2020. $

24. Total adjustments to the 2020 taxable value. Add Lines 22 and 23. $ 2,642,616

25. Adjusted 2020 taxable value. Subtract Line 24 from Line 21. $ 357,975,174

26. 2020 NNR tax rate. Divide Line 17 by Line 25 and multiply by $100. 20

$ 0.435250/$100

27. COUNTIES ONLY. Add together the NNR tax rates for each type of tax the county levies. The total is the 2020 county NNR tax rate. 21

$ /$100

SECTION 2: Voter-Approval Tax Rate

The voter-approval tax rate is the highest tax rate that a taxing unit may adopt without holding an election to seek voter approval of the rate. The voter-approval tax rate is split

into two separate rates:

1. Maintenance and Operations (M&O) Tax Rate: The M&O portion is the tax rate that is needed to raise the same amount of taxes that the taxing unit levied in the prior year

plus the applicable percentage allowed by law. This rate accounts for such things as salaries, utilities and day-to-day operations.

2. Debt Rate: The debt rate includes the debt service necessary to pay the taxing unit’s debt payments in the coming year. This rate accounts for principal and interest on bonds

and other debt secured by property tax revenue.

The voter-approval tax rate for a county is the sum of the voter-approval tax rates calculated for each type of tax the county levies. In most cases the voter-approval tax rate

exceeds the no-new-revenue tax rate, but occasionally decreases in a taxing unit’s debt service will cause the NNR tax rate to be higher than the voter-approval tax rate.

Line Voter-Approval Tax Rate Worksheet Amount/Rate

28. 2019 M&O tax rate. Enter the 2019 M&O tax rate. $ 0.370094/$100

29. 2019 taxable value, adjusted for actual and potential court-ordered adjustments. Enter the amount in Line 8 of the No-New-Revenue Tax

Rate Worksheet. $ 362,493,902

13 Tex. Tax Code § 26.01(c) and (d)

14 Tex. Tax Code § 26.01(c)

15 Tex. Tax Code § 26.01(d)

16 Tex. Tax Code § 26.012(6)(B)

17 Tex. Tax Code § 26.012(6)

18 Tex. Tax Code § 26.012(17)

19 Tex. Tax Code § 26.012(17)

20 Tex. Tax Code § 26.04(c)

21 Tex. Tax Code § 26.04(d)

For additional copies, visit: comptroller.texas.gov/taxes/property-tax Page 3