Page 88 - Pantego Adopted Budget FY21

P. 88

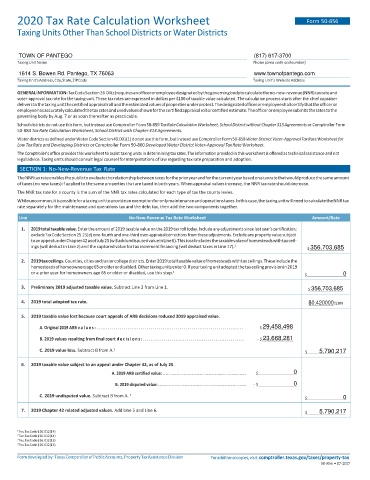

2020 Tax Rate Calculation Worksheet Form 50-856

Taxing Units Other Than School Districts or Water Districts

TOWN OF PANTEGO (817) 617-3700

Taxing Unit Name Phone (area code and number)

1614 S. Bowen Rd. Pantego, TX 76063 www.townofpantego.com

Taxing Unit’s Address, City, State, ZIP Code Taxing Unit’s Website Address

GENERAL INFORMATION: Tax Code Section 26.04(c) requires an officer or employee designated by the governing body to calculate the no-new-revenue (NNR) tax rate and

voter-approval tax rate for the taxing unit. These tax rates are expressed in dollars per $100 of taxable value calculated. The calculation process starts after the chief appraiser

delivers to the taxing unit the certified appraisal roll and the estimated values of properties under protest. The designated officer or employee shall certify that the officer or

employee has accurately calculated the tax rates and used values shown for the certified appraisal roll or certified estimate. The officer or employee submits the rates to the

governing body by Aug. 7 or as soon thereafter as practicable.

School districts do not use this form, but instead use Comptroller Form 50-859 Tax Rate Calculation Worksheet, School District without Chapter 313 Agreements or Comptroller Form

50-884 Tax Rate Calculation Worksheet, School District with Chapter 313 Agreements.

Water districts as defined under Water Code Section 49.001(1) do not use this form, but instead use Comptroller Form 50-858 Water District Voter-Approval Tax Rate Worksheet for

Low Tax Rate and Developing Districts or Comptroller Form 50-860 Developed Water District Voter-Approval Tax Rate Worksheet.

The Comptroller’s office provides this worksheet to assist taxing units in determining tax rates. The information provided in this worksheet is offered as technical assistance and not

legal advice. Taxing units should consult legal counsel for interpretations of law regarding tax rate preparation and adoption.

SECTION 1: No-New-Revenue Tax Rate

The NNR tax rate enables the public to evaluate the relationship between taxes for the prior year and for the current year based on a tax rate that would produce the same amount

of taxes (no new taxes) if applied to the same properties that are taxed in both years. When appraisal values increase, the NNR tax rate should decrease.

The NNR tax rate for a county is the sum of the NNR tax rates calculated for each type of tax the county levies.

While uncommon, it is possible for a taxing unit to provide an exemption for only maintenance and operations taxes. In this case, the taxing unit will need to calculate the NNR tax

rate separately for the maintenance and operations tax and the debt tax, then add the two components together.

Line No-New-Revenue Tax Rate Worksheet Amount/Rate

1. 2019 total taxable value. Enter the amount of 2019 taxable value on the 2019 tax roll today. Include any adjustments since last year’s certification;

exclude Tax Code Section 25.25(d) one-fourth and one-third over-appraisal corrections from these adjustments. Exclude any property value subject

to an appeal under Chapter 42 as of July 25 (will add undisputed value in Line 6). This total includes the taxable value of homesteads with tax ceil-

ings (will deduct in Line 2) and the captured value for tax increment financing (will deduct taxes in Line 17). 1 $ 356,703,685

2. 2019 tax ceilings. Counties, cities and junior college districts. Enter 2019 total taxable value of homesteads with tax ceilings. These include the

homesteads of homeowners age 65 or older or disabled. Other taxing units enter 0. If your taxing unit adopted the tax ceiling provision in 2019

or a prior year for homeowners age 65 or older or disabled, use this step. 2 0

$

3. Preliminary 2019 adjusted taxable value. Subtract Line 2 from Line 1. $ 356,703,685

4. 2019 total adopted tax rate. $0.420000/$100

5. 2019 taxable value lost because court appeals of ARB decisions reduced 2019 appraised value.

A. Original 2019 ARB v a l u e s : . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29,458,498

B. 2019 values resulting from final court de c is i ons : .. .. . .. .. ... .. ... .. ... ... ... .. ... .. ... .. ... .. ... .. ... - $ 23,668,281

3

C. 2019 value loss. Subtract B from A. $ 5,790,217

6. 2019 taxable value subject to an appeal under Chapter 42, as of July 25.

A. 2019 ARB certified value: ............................................................................ $ 0

B. 2019 disputed value:................................................................................. - $ 0

4

C. 2019 undisputed value. Subtract B from A. $ 0

7. 2019 Chapter 42 related adjusted values. Add Line 5 and Line 6. $ 5,790,217

1 Tex. Tax Code § 26.012(14)

2 Tex. Tax Code § 26.012(14)

3 Tex. Tax Code § 26.012(13)

4 Tex. Tax Code § 26.012(13)

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division For additional copies, visit: comptroller.texas.gov/taxes/property-tax

50-856 • 07-20/7