Page 44 - Keller Budget FY21

P. 44

FY 2020-21 STATISTICAL ANALYSIS

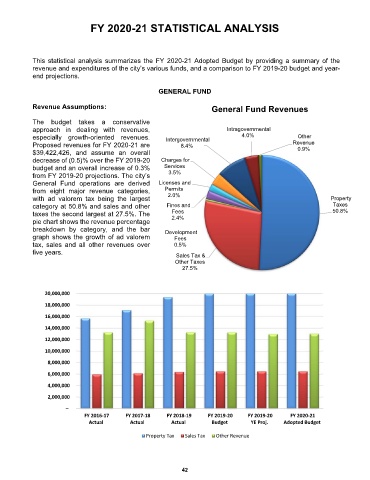

This statistical analysis summarizes the FY 2020-21 Adopted Budget by providing a summary of the

revenue and expenditures of the city’s various funds, and a comparison to FY 2019-20 budget and year-

end projections.

GENERAL FUND

Revenue Assumptions: General Fund Revenues

The budget takes a conservative

approach in dealing with revenues, Intragovernmental

especially growth-oriented revenues. Intergovernmental 4.0% Other

Proposed revenues for FY 2020-21 are 8.4% Revenue

$39,422,426, and assume an overall 0.9%

decrease of (0.5)% over the FY 2019-20 Charges for

budget and an overall increase of 0.3% Services

from FY 2019-20 projections. The city’s 3.5%

General Fund operations are derived Licenses and

from eight major revenue categories, Permits

with ad valorem tax being the largest 2.0% Property

category at 50.8% and sales and other Fines and Taxes

taxes the second largest at 27.5%. The Fees 50.8%

2.4%

pie chart shows the revenue percentage

breakdown by category, and the bar Development

graph shows the growth of ad valorem Fees

tax, sales and all other revenues over 0.5%

five years. Sales Tax &

Other Taxes

27.5%

20,000,000

18,000,000

16,000,000

14,000,000

12,000,000

10,000,000

8,000,000

6,000,000

4,000,000

2,000,000

–

FY 2016‐17 FY 2017‐18 FY 2018‐19 FY 2019‐20 FY 2019‐20 FY 2020‐21

Actual Actual Actual Budget YE Proj. Adopted Budget

Property Tax Sales Tax Other Revenue

42