Page 388 - Hurst Budget FY21

P. 388

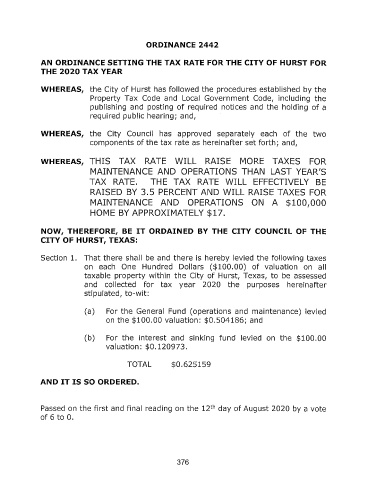

ORDINANCE 2442

AN ORDINANCE SETTING THE TAX RATE FOR THE CITY OF HURST FOR

THE 2020 TAX YEAR

WHEREAS, the City of Hurst has followed the procedures established by the

Property Tax Code and Local Government Code, including the

publishing and posting of required notices and the holding of a

required public hearing; and,

WHEREAS, the City Council has approved separately each of the two

components of the tax rate as hereinafter set forth; and,

WHEREAS, THIS TAX RATE WILL RAISE MORE TAXES FOR

MAINTENANCE AND OPERATIONS THAN LAST YEAR' S

TAX RATE. THE TAX RATE WILL EFFECTIVELY BE

RAISED BY 3. 5 PERCENT AND WILL RAISE TAXES FOR

MAINTENANCE AND OPERATIONS ON A $ 100, 000

HOME BY APPROXIMATELY $ 17.

NOW, THEREFORE, BE IT ORDAINED BY THE CITY COUNCIL OF THE

CITY OF HURST, TEXAS:

Section 1. That there shall be and there is hereby levied the following taxes

on each One Hundred Dollars ($ 100. 00) of valuation on all

taxable property within the City of Hurst, Texas, to be assessed

and collected for tax year 2020 the purposes hereinafter

stipulated, to -wit:

a) For the General Fund ( operations and maintenance) levied

on the $ 100. 00 valuation: $ 0. 504186; and

b) For the interest and sinking fund levied on the $ 100. 00

valuation: $ 0. 120973.

TOTAL $ 0. 625159

AND IT IS SO ORDERED,

Passed on the first and final reading on the 12th day of August 2020 by a vote

of6to0.

376