Page 158 - Hurst Budget FY21

P. 158

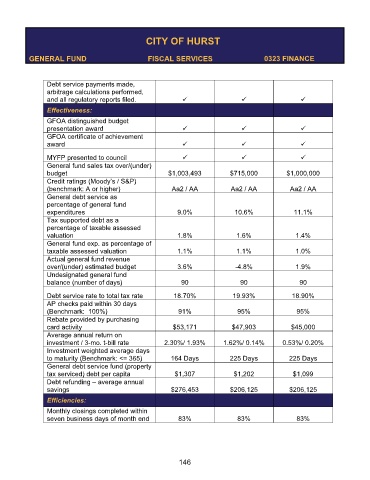

CITY OF HURST

GENERAL FUND FISCAL SERVICES 0323 FINANCE

Debt service payments made,

arbitrage calculations performed,

and all regulatory reports filed.

Effectiveness:

GFOA distinguished budget

presentation award

GFOA certificate of achievement

award

MYFP presented to council

General fund sales tax over/(under)

budget $1,003,493 $715,000 $1,000,000

Credit ratings (Moody’s / S&P)

(benchmark: A or higher) Aa2 / AA Aa2 / AA Aa2 / AA

General debt service as

percentage of general fund

expenditures 9.0% 10.6% 11.1%

Tax supported debt as a

percentage of taxable assessed

valuation 1.8% 1.6% 1.4%

General fund exp. as percentage of

taxable assessed valuation 1.1% 1.1% 1.0%

Actual general fund revenue

over/(under) estimated budget 3.6% -4.8% 1.9%

Undesignated general fund

balance (number of days) 90 90 90

Debt service rate to total tax rate 18.70% 19.93% 18.90%

AP checks paid within 30 days

(Benchmark: 100%) 91% 95% 95%

Rebate provided by purchasing

card activity $53,171 $47,903 $45,000

Average annual return on

investment / 3-mo. t-bill rate 2.30%/ 1.93% 1.62%/ 0.14% 0.53%/ 0.20%

Investment weighted average days

to maturity (Benchmark: <= 365) 164 Days 225 Days 225 Days

General debt service fund (property

tax serviced) debt per capita $1,307 $1,202 $1,099

Debt refunding – average annual

savings $276,453 $206,125 $206,125

Efficiencies:

Monthly closings completed within

seven business days of month end 83% 83% 83%

146