Page 157 - Hurst Budget FY21

P. 157

CITY OF HURST

GENERAL FUND FISCAL SERVICES 0323 FINANCE

Include balanced and conservative projections of sales tax revenue and bonded

indebtedness within multi-year financial plans.

Minimize the impact to the property tax rate when issuing or refunding debt.

Maintain level of City services and enhance services if justified and approved by Council.

Provide for infrastructure maintenance and facility improvements in the operating

budget.

Monitor economic conditions, including interest rates, to identify areas of financial risk

that may impact the budget.

Conduct timely reviews of financial data to proactively search for unusual transactions or

breakdowns of internal controls.

Monitor and report the budgetary status of all revenues and expenditures throughout the

fiscal year and publish monthly, quarterly, and annual financial reports.

Maintain a return on investment rate equal to or greater than the three-month U.S.

Treasury Bill rate and maintain a weighted average maturity in compliance with the City’s

Investment Policy.

Respond to all vendor and customer requests within one week.

Pay invoices within 30 days of receipt.

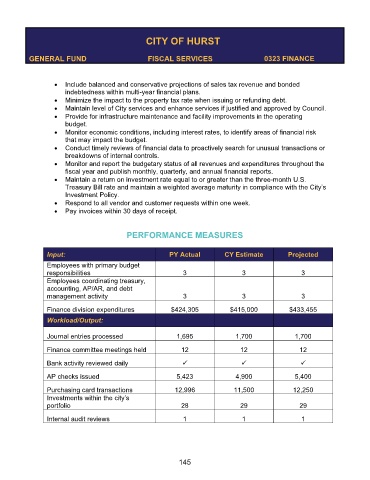

PERFORMANCE MEASURES

Input: PY Actual CY Estimate Projected

Employees with primary budget

responsibilities 3 3 3

Employees coordinating treasury,

accounting, AP/AR, and debt

management activity 3 3 3

Finance division expenditures $424,305 $415,000 $433,455

Workload/Output:

Journal entries processed 1,695 1,700 1,700

Finance committee meetings held 12 12 12

Bank activity reviewed daily

AP checks issued 5,423 4,900 5,400

Purchasing card transactions 12,996 11,500 12,250

Investments within the city’s

portfolio 28 29 29

Internal audit reviews 1 1 1

145