Page 55 - Grapevine Budget FY21

P. 55

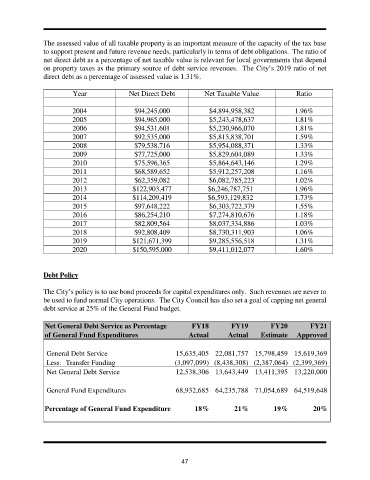

The assessed value of all taxable property is an important measure of the capacity of the tax base

to support present and future revenue needs, particularly in terms of debt obligations. The ratio of

net direct debt as a percentage of net taxable value is relevant for local governments that depend

on property taxes as the primary source of debt service revenues. The City’s 2019 ratio of net

direct debt as a percentage of assessed value is 1.31%.

Year Net Direct Debt Net Taxable Value Ratio

2004 $94,245,000 $4,894,958,382 1.96%

2005 $94,965,000 $5,243,478,637 1.81%

2006 $94,531,601 $5,230,966,070 1.81%

2007 $92,535,000 $5,815,838,701 1.59%

2008 $79,538,716 $5,954,088,371 1.33%

2009 $77,725,000 $5,829,604,089 1.33%

2010 $75,596,365 $5,864,643,146 1.29%

2011 $68,589,652 $5,912,257,208 1.16%

2012 $62,359,082 $6,082,785,223 1.02%

2013 $122,903,477 $6,246,787,751 1.96%

2014 $114,209,419 $6,593,129,832 1.73%

2015 $97,648,222 $6,303,722,379 1.55%

2016 $86,254,210 $7,274,810,676 1.18%

2017 $82,809,564 $8,037,334,886 1.03%

2018 $92,808,409 $8,730,311,903 1.06%

2019 $121,671,399 $9,285,556,518 1.31%

2020 $150,595,000 $9,411,012,077 1.60%

Debt Policy

The City’s policy is to use bond proceeds for capital expenditures only. Such revenues are never to

be used to fund normal City operations. The City Council has also set a goal of capping net general

debt service at 25% of the General Fund budget.

Net General Debt Service as Percentage FY18 FY19 FY20 FY21

of General Fund Expenditures Actual Actual Estimate Approved

General Debt Service 15,635,405 22,081,757 15,798,459 15,619,369

Less: Transfer Funding (3,097,099) (8,438,308) (2,387,064) (2,399,369)

Net General Debt Service 12,538,306 13,643,449 13,411,395 13,220,000

General Fund Expenditures 68,932,685 64,235,788 71,054,689 64,519,648

Percentage of General Fund Expenditure 18% 21% 19% 20%

47