Page 34 - Forest Hill FY21 Annual Budget

P. 34

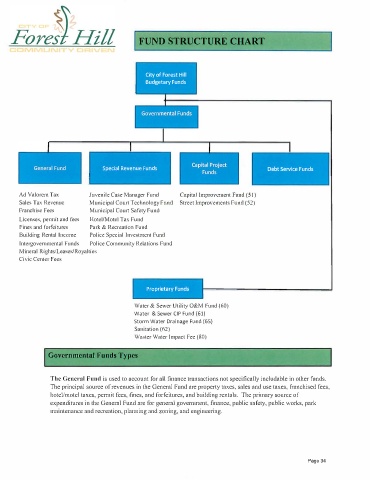

FUND STRUCTURE CHART

City of Forest Hill

I Budgetary Funds

Special Revenue Funds Debt Service Funds

I

I

Ad Valorem Tax Juvenile Case Manager Fund Capital Improvement Fund (51)

Sales Tax Revenue Municipal Court Technology Fund Street Improvements Fund (52)

Franchise Fees Municipal Court Safety Fund

Licenses, permit and fees Hotel/Motel Tax Fund

Fines and forfeitures Park & Recreation Fund

Building Rental Income Police Special Investment Fund

Intergovernmental Funds Police Community Relations Fund

Mineral Rights/Leases/Royalties

Civic Center Fees

Proprietary Funds

Water & Sewer Utility O&M Fund (60)

Water & Sewer CIP Fund (61)

Storm Water Drainage Fund (65)

Sanitation (62)

Waster Water Impact Fee (80)

Governmental Funds Types

The General Fund is used to account for all finance transactions not specifically includable in other funds.

The principal source of revenues in the General Fund are property taxes, sales and use taxes, franchised fees,

hotel/motel taxes, permit fees, fines, and forfeitures, and building rentals. The primary source of

expenditures in the General Fund are for general government, finance, public safety, public works, park

maintenance and recreation, planning and zoning, and engineering.

Page 34