Page 18 - Crowley FY21 Budget

P. 18

Firefox http:// truth-hi-taxation.com/ PriiitForjns.asp.x

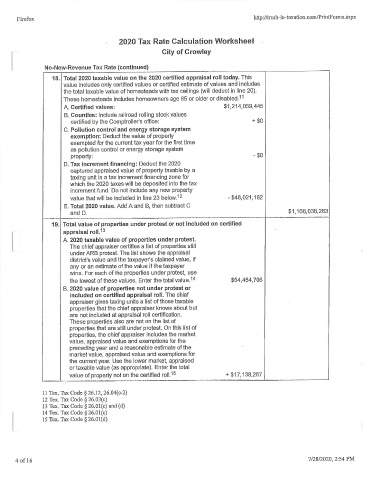

2020 Tax Rafe Calculation Worksheet

City of Crowley

No- New - Revenue Tax Rate ( continued)

18. Total 2020 taxable value on the 2020 certified appraisal roll today. This

value includes only certified values or certified estimate of values and includes

the total taxable value of homesteads with tax ceilings ( will deduct in line 20).

These homesteads includes homeowners age 65 or older or disabled. 11

A. Certified values: $ 1, 214, 059,445

B. Counties: Include railroad rolling stock values

certified by the Comptroller's office: +$ 0

C. Pollution control and energy storage system

exemption: Deduct the value of property

exempted for the current tax year for the first time

as pollution control or energy storage system

0

property: -$

D. Tax increment financing: Deduct the 2020

captured appraised value of property taxable by a

taxing unit in a tax increment financing zone for

which the 2020 taxes will be deposited into the tax

increment fund. Do not include any new property

value that will be included in line 23 below.12 - $ 48, 021, 182

E. Total 2020 value. Add A and B, then subtract C

and D. 1, 166, 038, 263

19. Total value of properties under protestor not included on certified

appraisal roll. 13

A. 2020 taxable value of properties under protest.

The chief appraiser certifies a list of properties still

under ARB protest. The list shows the appraisal

district's value and the taxpayer's claimed value, if

any or an estimate of the value if the taxpayer

wins. For each of the properties under protest, use

the lowest of these values. Enter the total value. 14 $ 54, 454, 706

B. 2020 value of properties not under protest or

included on certified appraisal roll. The chief

appraiser gives taxing units a list of those taxable

properties that the chief appraiser knows about but

are not included at appraisal roll certification.

These properties also are not on the list of

properties that are still under protest. On this list of

properties, the chief appraiser includes the market

value, appraised value and exemptions for the

preceding year and a reasonable estimate of the

market value, appraised value and exemptions for

the current year. Use the lower market, appraised

or taxable value ( as appropriate). Enter the total

value of property not on the certified roll.15 + $ 17, 138, 267

11 Tex. Tax Code § 26. 12, 26. 04( c -2)

12 Tex. Tax Code § 26. 03( c)

13 Tex. Tax Code § 26. 01( c) and ( d)

14 Tex. Tax Code § 26. 01( c)

15 Tex. Tax Code § 26.01( d)

7/ 28/ 2020, 2: 54 PM

4 of 16