Page 16 - Crowley FY21 Budget

P. 16

Firefox http:// trutli-irl-taxation.com/PrhitFonns.aspx

TNT -856 06 -20/ 6

ii ". 9

fV MA

City of Crowley

201 E Main Street Crowley TX 76036

817 - 297 -2201

www.c!.crowley.tx. us

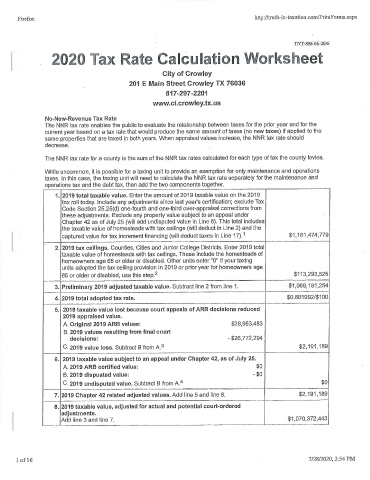

No -New- Revenue Tax Rate

The NNR tax rate enables the public to evaluate the relationship between taxes for the prior year and for the

current year based on a tax rate that would produce the same amount of taxes (no new taxes) if applied to the

same properties that are taxed in both years. When appraisal values increase, the NNR tax rate should

decrease.

The NNR tax rate for a county is the sum of the NNR tax rates calculated for each type of tax the county levies.

While uncommon, it is possible for a taxing unit to provide an exemption for only maintenance and operations

taxes. In this case, the taxing unit will need to calculate the NNR tax rate separately for the maintenance and

operations tax and the debt tax, then add the two components together.

1. 2019 total taxable value. Enter the amount of 2019 taxable value on the 2019

tax roll today. Include any adjustments since last year's certification; exclude Tax

Code Section 25.25(d) one - fourth and one -third over - appraisal corrections from

these adjustments. Exclude any property value subject to an appeal under

Chapter 42 as of July 25 (will add undisputed value in Line 6). This total includes

the taxable value of homesteads with tax ceilings (will deduct in Line 2) and the

captured value for tax increment financing (will deduct taxes in Line 17). 1 1, 181, 474,779

2. 2019 tax ceilings. Counties, Cities and Junior College Districts. Enter 2019 total

taxable value of homesteads with tax ceilings. These include the homesteads of

homeowners age 65 or older or disabled. Other units enter "0" If your taxing

units adopted the tax ceiling provision in 2019 or prior year for homeowners age

65 or older or disabled, use this step.2 113, 293, 525

3. Preliminary 2019 adjusted taxable value. Subtract line 2 from line 1. 1, 068, 181, 254

4. 2019 total adopted tax rate. 0. 681992/$ 100

5. 2019 taxable value lost because court appeals of ARB decisions reduced

2019 appraised value.

A. Original 2019 ARB values: $ 28, 963,483

B. 2019 values resulting from final court

decisions: - $ 26,772,294

C. 2019 value loss. Subtract B from A. 3 2, 191, 189

6. 2019 taxable value subject to an appeal under Chapter 42, as of July 25.

A. 2019 ARB certified value: $ 0

B. 2019 dispuated value: _$ 0

C. 2019 undisputed value. Subtract B from A.4 0

7. 2019 Chapter 42 related adjusted values. Add line 5 and line 6. 2, 191, 189

8. 2019 taxable value, adjusted for actual and potential court- ordered

adjustments.

Add line 3 and line 7. 1, 070, 372, 443

1 of 16 7/ 28/ 2020, 2: 54 PM