Page 59 - Colleyville FY21 Budget

P. 59

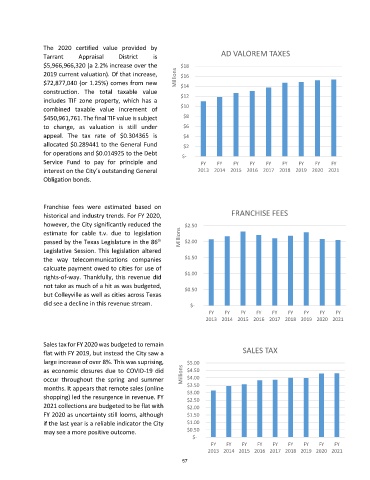

The 2020 certified value provided by

AD VALOREM TAXES

Tarrant Appraisal District is

$5,966,966,320 (a 2.2% increase over the $18

2019 current valuation). Of that increase, Millions $16

$72,877,040 (or 1.25%) comes from new $14

construction. The total taxable value

$12

includes TIF zone property, which has a

$10

combined taxable value increment of

$450,961,761. The final TIF value is subject $8

to change, as valuation is still under $6

appeal. The tax rate of $0.304365 is $4

allocated $0.289441 to the General Fund $2

for operations and $0.014925 to the Debt

$-

Service Fund to pay for principle and FY FY FY FY FY FY FY FY FY

interest on the City’s outstanding General 2013 2014 2015 2016 2017 2018 2019 2020 2021

Obligation bonds.

Franchise fees were estimated based on

historical and industry trends. For FY 2020, FRANCHISE FEES

however, the City significantly reduced the $2.50

estimate for cable t.v. due to legislation Millions

th

passed by the Texas Legislature in the 86 $2.00

Legislative Session. This legislation altered

the way telecommunications companies $1.50

calcuate payment owed to cities for use of

$1.00

rights-of-way. Thankfully, this revenue did

not take as much of a hit as was budgeted,

$0.50

but Colleyville as well as cities across Texas

did see a decline in this revenue stream. $-

FY FY FY FY FY FY FY FY FY

2013 2014 2015 2016 2017 2018 2019 2020 2021

Sales tax for FY 2020 was budgeted to remain

flat with FY 2019, but instead the City saw a SALES TAX

large increase of over 8%. This was suprising, $5.00

as economic closures due to COVID-19 did Millions $4.50

occur throughout the spring and summer $4.00

months. It appears that remote sales (online $3.50

$3.00

shopping) led the resurgence in revenue. FY

$2.50

2021 collections are budgeted to be flat with $2.00

FY 2020 as uncertainty still looms, although $1.50

if the last year is a reliable indicator the City $1.00

may see a more positive outcome. $0.50

$-

FY FY FY FY FY FY FY FY FY

2013 2014 2015 2016 2017 2018 2019 2020 2021

57