Page 288 - Colleyville FY21 Budget

P. 288

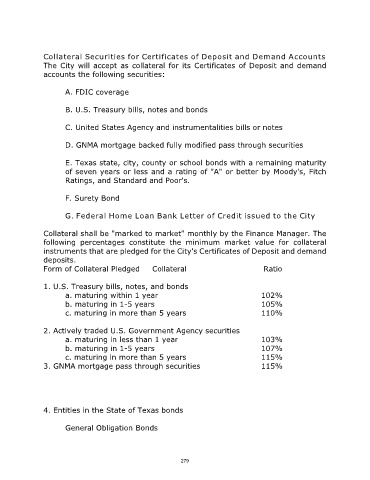

Collateral Securities for Certificates of Deposit and Demand Accounts

The City will accept as collateral for its Certificates of Deposit and demand

accounts the following securities:

A. FDIC coverage

B. U.S. Treasury bills, notes and bonds

C. United States Agency and instrumentalities bills or notes

D. GNMA mortgage backed fully modified pass through securities

E. Texas state, city, county or school bonds with a remaining maturity

of seven years or less and a rating of "A" or better by Moody's, Fitch

Ratings, and Standard and Poor's.

F. Surety Bond

G. Federal Home Loan Bank Letter of Credit issued to the City

Collateral shall be "marked to market" monthly by the Finance Manager. The

following percentages constitute the minimum market value for collateral

instruments that are pledged for the City's Certificates of Deposit and demand

deposits.

Form of Collateral Pledged Collateral Ratio

1. U.S. Treasury bills, notes, and bonds

a. maturing within 1 year 102%

b. maturing in 1-5 years 105%

c. maturing in more than 5 years 110%

2. Actively traded U.S. Government Agency securities

a. maturing in less than 1 year 103%

b. maturing in 1-5 years 107%

c. maturing in more than 5 years 115%

3. GNMA mortgage pass through securities 115%

4. Entities in the State of Texas bonds

General Obligation Bonds

279