Page 286 - Colleyville FY21 Budget

P. 286

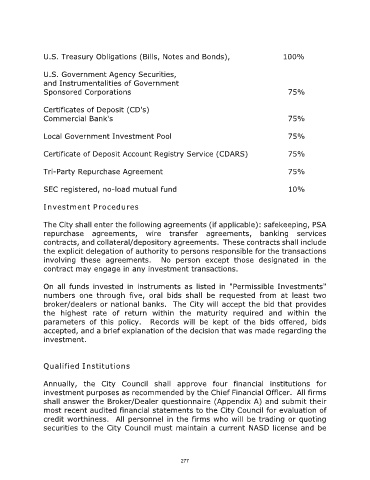

U.S. Treasury Obligations (Bills, Notes and Bonds), 100%

U.S. Government Agency Securities,

and Instrumentalities of Government

Sponsored Corporations 75%

Certificates of Deposit (CD's)

Commercial Bank's 75%

Local Government Investment Pool 75%

Certificate of Deposit Account Registry Service (CDARS) 75%

Tri-Party Repurchase Agreement 75%

SEC registered, no-load mutual fund 10%

Investment Procedures

The City shall enter the following agreements (if applicable): safekeeping, PSA

repurchase agreements, wire transfer agreements, banking services

contracts, and collateral/depository agreements. These contracts shall include

the explicit delegation of authority to persons responsible for the transactions

involving these agreements. No person except those designated in the

contract may engage in any investment transactions.

On all funds invested in instruments as listed in "Permissible Investments"

numbers one through five, oral bids shall be requested from at least two

broker/dealers or national banks. The City will accept the bid that provides

the highest rate of return within the maturity required and within the

parameters of this policy. Records will be kept of the bids offered, bids

accepted, and a brief explanation of the decision that was made regarding the

investment.

Qualified Institutions

Annually, the City Council shall approve four financial institutions for

investment purposes as recommended by the Chief Financial Officer. All firms

shall answer the Broker/Dealer questionnaire (Appendix A) and submit their

most recent audited financial statements to the City Council for evaluation of

credit worthiness. All personnel in the firms who will be trading or quoting

securities to the City Council must maintain a current NASD license and be

277