Page 205 - Colleyville FY21 Budget

P. 205

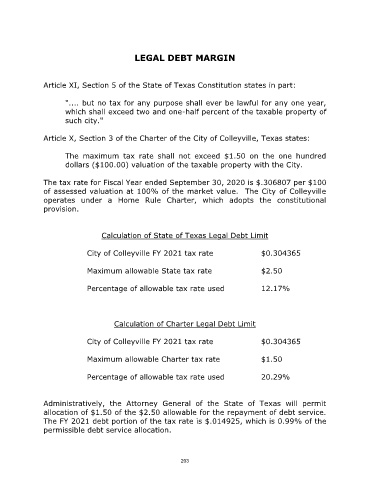

LEGAL DEBT MARGIN

Article XI, Section 5 of the State of Texas Constitution states in part:

".... but no tax for any purpose shall ever be lawful for any one year,

which shall exceed two and one-half percent of the taxable property of

such city."

Article X, Section 3 of the Charter of the City of Colleyville, Texas states:

The maximum tax rate shall not exceed $1.50 on the one hundred

dollars ($100.00) valuation of the taxable property with the City.

The tax rate for Fiscal Year ended September 30, 2020 is $.306807 per $100

of assessed valuation at 100% of the market value. The City of Colleyville

operates under a Home Rule Charter, which adopts the constitutional

provision.

Calculation of State of Texas Legal Debt Limit

City of Colleyville FY 2021 tax rate $0.304365

Maximum allowable State tax rate $2.50

Percentage of allowable tax rate used 12.17%

Calculation of Charter Legal Debt Limit

City of Colleyville FY 2021 tax rate $0.304365

Maximum allowable Charter tax rate $1.50

Percentage of allowable tax rate used 20.29%

Administratively, the Attorney General of the State of Texas will permit

allocation of $1.50 of the $2.50 allowable for the repayment of debt service.

The FY 2021 debt portion of the tax rate is $.014925, which is 0.99% of the

permissible debt service allocation.

203