Page 202 - Colleyville FY21 Budget

P. 202

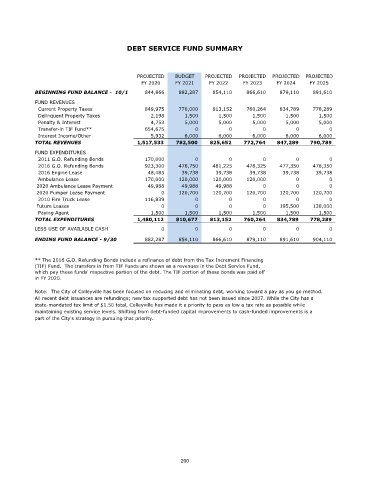

DEBT SERVICE FUND SUMMARY

PROJECTED BUDGET PROJECTED PROJECTED PROJECTED PROJECTED

FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025

BEGINNING FUND BALANCE - 10/1 844,866 882,287 854,110 866,610 879,110 891,610

FUND REVENUES

Current Property Taxes 849,975 770,000 813,152 760,264 834,789 778,289

Delinquent Property Taxes 2,198 1,500 1,500 1,500 1,500 1,500

Penalty & Interest 4,753 5,000 5,000 5,000 5,000 5,000

Transfer-in TIF Fund** 654,675 0 0 0 0 0

Interest Income/Other 5,932 6,000 6,000 6,000 6,000 6,000

TOTAL REVENUES 1,517,533 782,500 825,652 772,764 847,289 790,789

FUND EXPENDITURES

2011 G.O. Refunding Bonds 170,000 0 0 0 0 0

2016 G.O. Refunding Bonds 923,300 478,750 481,225 478,325 477,350 478,350

2016 Engine Lease 48,485 39,738 39,738 39,738 39,738 39,738

Ambulance Lease 170,000 120,000 120,000 120,000 0 0

2020 Ambulance Lease Payment 49,988 49,988 49,988 0 0 0

2020 Pumper Lease Payment 0 120,700 120,700 120,700 120,700 120,700

2010 Fire Truck Lease 116,839 0 0 0 0 0

Future Leases 0 0 0 0 195,500 138,000

Paying Agent 1,500 1,500 1,500 1,500 1,500 1,500

TOTAL EXPENDITURES 1,480,112 810,677 813,152 760,264 834,789 778,289

LESS USE OF AVAILABLE CASH 0 0 0 0 0 0

ENDING FUND BALANCE - 9/30 882,287 854,110 866,610 879,110 891,610 904,110

** The 2016 G.O. Refunding Bonds include a refinance of debt from the Tax Increment Financing

(TIF) Fund. The transfers in from TIF Funds are shown as a revenues in the Debt Service Fund,

which pay those funds' respective portion of the debt. The TIF portion of these bonds was paid off

in FY 2020.

Note: The City of Colleyville has been focused on reducing and eliminating debt, working toward a pay as you go method.

All recent debt issuances are refundings; new tax supported debt has not been issued since 2007. While the City has a

state-mandated tax limit of $1.50 total, Colleyville has made it a priority to pass as low a tax rate as possible while

maintaining existing service levels. Shifting from debt-funded capital improvements to cash-funded improvements is a

part of the City's strategy in pursuing that priority.

200