Page 98 - Benbrook FY2021

P. 98

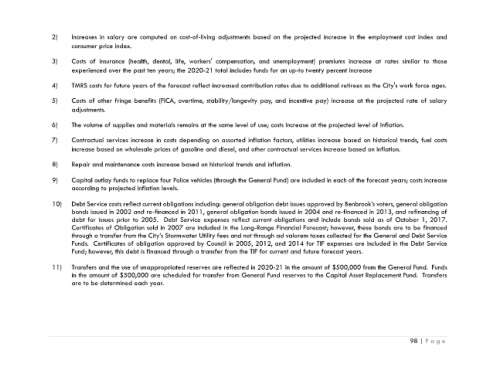

2) Increases in salary are computed on cost-of-living adjustments based on the projected increase in the employment cost index and

consumer price index.

3) Costs of insurance (health, dental, life, workers' compensation, and unemployment) premiums increase at rates similar to those

experienced over the past ten years; the 2020-21 total includes funds for an up-to twenty percent increase

4) TMRS costs for future years of the forecast reflect increased contribution rates due to additional retirees as the City's work force ages.

5) Costs of other fringe benefits (FICA, overtime, stability/longevity pay, and incentive pay) increase at the projected rate of salary

adjustments.

6) The volume of supplies and materials remains at the same level of use; costs increase at the projected level of inflation.

7) Contractual services increase in costs depending on assorted inflation factors, utilities increase based on historical trends, fuel costs

increase based on wholesale prices of gasoline and diesel, and other contractual services increase based on inflation.

8) Repair and maintenance costs increase based on historical trends and inflation.

9) Capital outlay funds to replace four Police vehicles (through the General Fund) are included in each of the forecast years; costs increase

according to projected inflation levels.

10) Debt Service costs reflect current obligations including: general obligation debt issues approved by Benbrook’s voters, general obligation

bonds issued in 2002 and re-financed in 2011, general obligation bonds issued in 2004 and re-financed in 2013, and refinancing of

debt for issues prior to 2005. Debt Service expenses reflect current obligations and include bonds sold as of October 1, 2017.

Certificates of Obligation sold in 2007 are included in the Long-Range Financial Forecast; however, these bonds are to be financed

through a transfer from the City’s Stormwater Utility fees and not through ad valorem taxes collected for the General and Debt Service

Funds. Certificates of obligation approved by Council in 2005, 2012, and 2014 for TIF expenses are included in the Debt Service

Fund; however, this debt is financed through a transfer from the TIF for current and future forecast years.

11) Transfers and the use of unappropriated reserves are reflected in 2020-21 in the amount of $500,000 from the General Fund. Funds

in the amount of $500,000 are scheduled for transfer from General Fund reserves to the Capital Asset Replacement Fund. Transfers

are to be determined each year.

98 | P a g e