Page 69 - Benbrook FY2021

P. 69

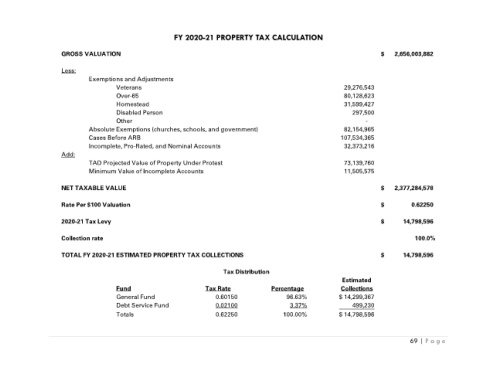

FY 2020-21 PROPERTY TAX CALCULATION

GROSS VALUATION $ 2,656,003,882

Less:

Exemptions and Adjustments

Veterans 29,276,543

Over-65 80,128,623

Homestead 31,599,427

Disabled Person 297,500

Other -

Absolute Exemptions (churches, schools, and government) 82,154,965

Cases Before ARB 107,534,365

Incomplete, Pro-Rated, and Nominal Accounts 32,373,216

Add:

TAD Projected Value of Property Under Protest 73,139,760

Minimum Value of Incomplete Accounts 11,505,575

NET TAXABLE VALUE $ 2,377,284,578

Rate Per $100 Valuation $ 0.62250

2020-21 Tax Levy $ 14,798,596

Collection rate 100.0%

TOTAL FY 2020-21 ESTIMATED PROPERTY TAX COLLECTIONS $ 14,798,596

Tax Distribution

Estimated

Fund Tax Rate Percentage Collections

General Fund 0.60150 96.63% $ 14,299,367

Debt Service Fund 0.02100 3.37% 499,230

Totals 0.62250 100.00% $ 14,798,596

69 | P a g e