Page 192 - City of Bedford FY21 Budget

P. 192

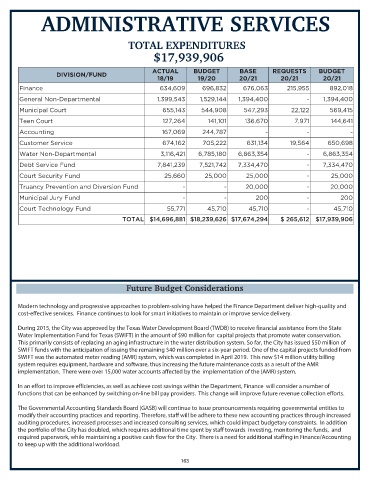

ADMINISTRATIVE SERVICES

TOTAL EXPENDITURES

$17,939,906

ACTUAL BUDGET BASE REQUESTS BUDGET

DIVISION/FUND

18/19 19/20 20/21 20/21 20/21

Finance 634,609 696,832 676,063 215,955 892,018

General Non-Departmental 1,399,543 1,529,144 1,394,400 - 1,394,400

Municipal Court 655,143 544,908 547,293 22,122 569,415

Teen Court 127,264 141,101 136,670 7,971 144,641

Accounting 167,069 244,787 - - -

Customer Service 674,162 705,222 631,134 19,564 650,698

Water Non-Departmental 3,116,421 6,785,180 6,863,354 - 6,863,354

Debt Service Fund 7,841,239 7,521,742 7,334,470 - 7,334,470

Court Security Fund 25,660 25,000 25,000 - 25,000

Truancy Prevention and Diversion Fund - - 20,000 - 20,000

Municipal Jury Fund - - 200 - 200

Court Technology Fund 55,771 45,710 45,710 - 45,710

TOTAL $14,696,881 $18,239,626 $17,674,294 $ 265,612 $17,939,906

Future Budget Considerations

Modern technology and progressive approaches to problem-solving have helped the Finance Department deliver high-quality and

cost-effective services. Finance continues to look for smart initiatives to maintain or improve service delivery.

During 2015, the City was approved by the Texas Water Development Board (TWDB) to receive financial assistance from the State

Water Implementation Fund for Texas (SWIFT) in the amount of $90 million for capital projects that promote water conservation.

This primarily consists of replacing an aging infrastructure in the water distribution system. So far, the City has issued $50 million of

SWIFT funds with the anticipation of issuing the remaining $40 million over a six-year period. One of the capital projects funded from

SWIFT was the automated meter reading (AMR) system, which was completed in April 2019. This new $14 million utility billing

system requires equipment, hardware and software, thus increasing the future maintenance costs as a result of the AMR

implementation. There were over 15,000 water accounts affected by the implementation of the (AMR) system.

In an effort to improve efficiencies, as well as achieve cost savings within the Department, Finance will consider a number of

functions that can be enhanced by switching on-line bill pay providers. This change will improve future revenue collection efforts.

The Governmental Accounting Standards Board (GASB) will continue to issue pronouncements requiring governmental entities to

modify their accounting practices and reporting. Therefore, staff will be adhere to these new accounting practices through increased

auditing procedures, increased processes and increased consulting services, which could impact budgetary constraints. In addition

the portfolio of the City has doubled, which requires additional time spent by staff towards investing, monitoring the funds, and

required paperwork, while maintaining a positive cash flow for the City. There is a need for additional staffing in Finance/Accounting

to keep up with the additional workload.

163