Page 73 - FY 2020-21 Budget Cover.pub

P. 73

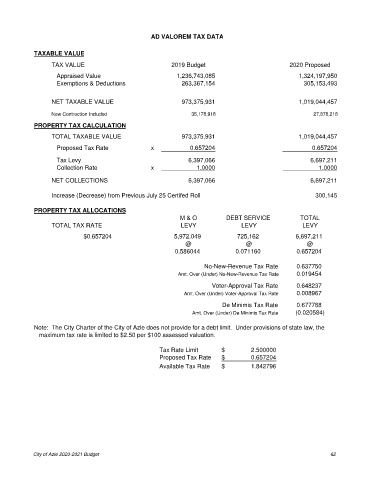

AD VALOREM TAX DATA

TAXABLE VALUE

TAX VALUE 2019 Budget 2020 Proposed

Appraised Value 1,236,743,085 1,324,197,950

Exemptions & Deductions 263,367,154 305,153,493

NET TAXABLE VALUE 973,375,931 1,019,044,457

New Contruction Included 35,178,918 27,878,218

PROPERTY TAX CALCULATION

TOTAL TAXABLE VALUE 973,375,931 1,019,044,457

Proposed Tax Rate x 0.657204 0.657204

Tax Levy 6,397,066 6,697,211

Collection Rate x 1.0000 1.0000

NET COLLECTIONS 6,397,066 6,697,211

Increase (Decrease) from Previous July 25 Certifed Roll 300,145

PROPERTY TAX ALLOCATIONS

M & O DEBT SERVICE TOTAL

TOTAL TAX RATE LEVY LEVY LEVY

$0.657204 5,972,049 725,162 6,697,211

@ @ @

0.586044 0.071160 0.657204

No-New-Revenue Tax Rate 0.637750

Amt. Over (Under) No-New-Revenue Tax Rate 0.019454

Voter-Approval Tax Rate 0.648237

Amt. Over (Under) Voter-Approval Tax Rate 0.008967

De Minimis Tax Rate 0.677788

Amt. Over (Under) De Minimis Tax Rate (0.020584)

Note: The City Charter of the City of Azle does not provide for a debt limit. Under provisions of state law, the

maximum tax rate is limited to $2.50 per $100 assessed valuation.

Tax Rate Limit $ 2.500000

Proposed Tax Rate $ 0.657204

Available Tax Rate $ 1.842796

City of Azle 2020-2021 Budget 62