Page 26 - FY 2020-21 Budget Cover.pub

P. 26

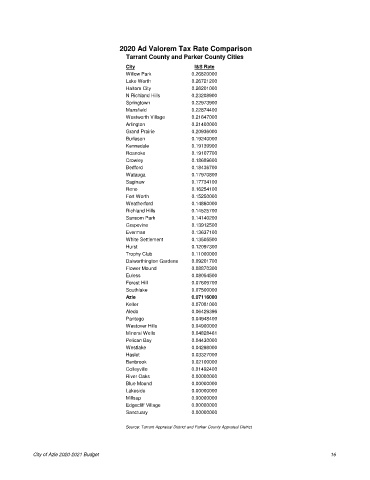

2020 Ad Valorem Tax Rate Comparison

Tarrant County and Parker County Cities

City I&S Rate

Willow Park 0.26820000

Lake Worth 0.26721200

Haltom City 0.26201000

N Richland Hills 0.23208900

Springtown 0.22973900

Mansfield 0.22874400

Westworth Village 0.21647000

Arlington 0.21400000

Grand Prairie 0.20936000

Burleson 0.19240000

Kennedale 0.19139900

Roanoke 0.19107700

Crowley 0.18689600

Bedford 0.18436700

Watauga 0.17970800

Saginaw 0.17734100

Reno 0.16254100

Fort Worth 0.15250000

Weatherford 0.14860000

Richland Hills 0.14525700

Sansom Park 0.14140200

Grapevine 0.13912500

Everman 0.13637100

White Settlement 0.13505500

Hurst 0.12097300

Trophy Club 0.11000000

Dalworthington Gardens 0.09201700

Flower Mound 0.08870300

Euless 0.08054500

Forest Hill 0.07609700

Southlake 0.07500000

Azle 0.07116000

Keller 0.07081000

Aledo 0.06429396

Pantego 0.04948400

Westover Hills 0.04900000

Mineral Wells 0.04828461

Pelican Bay 0.04430000

Westlake 0.04298000

Haslet 0.03327000

Benbrook 0.02100000

Colleyville 0.01492400

River Oaks 0.00000000

Blue Mound 0.00000000

Lakeside 0.00000000

Millsap 0.00000000

Edgecliff Village 0.00000000

Sanctuary 0.00000000

Source: Tarrant Appraisal District and Parker County Appraisal District

City of Azle 2020-2021 Budget 16