Page 17 - City of Westlake FY20 Budget

P. 17

Section 01 Executive

Transmittal Letter

III. IMPACT OF THE LEGISLATIVE SESSION

th

During the 86 Texas legislative session, the Legislature passed several bills that impacts the Town.

Some of these bills have affected the adopted FY 19-20 budget, including reductions in the

telecommunications franchise fees totaling approximately $514K in revenue. The impact of other bills

will necessitate changes in our internal operations as well as our revenue forecasts in future years. A

condensed list of the bill numbers and titles are shown below:

• Senate Bill 2 – 3.5% cap on maintenance and operations funding from property tax

• Senate Bill 64 – Cybersecurity Data Protection

• House Bill 3 – School Funding

• House Bill 831 – Candidate Residency Requirements

• House Bill 2439 – Building Materials

• House Bill 2840 – Public Speaking at Meetings

• House Bill 3167 – Relative to Plat/Plan Approvals

These bills will alter the methodology the Town utilizes to raise revenues to fund both municipal and

academic service delivery and will alter certain components of our processes. As we continue to receive

updates from the oversight agencies, seek input from our municipal attorney, and implement the

necessary changes, staff will update the Council accordingly.

IV. AD VALOREM (PROPERTY TAX) RATE AND EXEMPTIONS

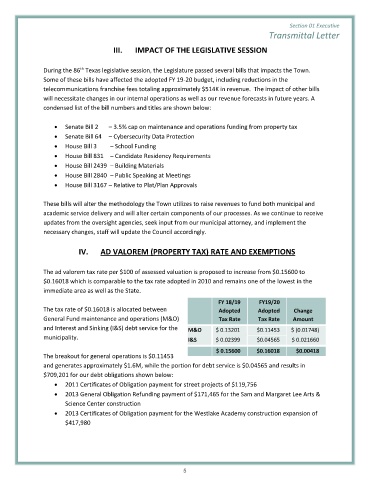

The ad valorem tax rate per $100 of assessed valuation is proposed to increase from $0.15600 to

$0.16018 which is comparable to the tax rate adopted in 2010 and remains one of the lowest in the

immediate area as well as the State.

FY 18/19 FY19/20

The tax rate of $0.16018 is allocated between Adopted Adopted Change

General Fund maintenance and operations (M&O) Tax Rate Tax Rate Amount

and Interest and Sinking (I&S) debt service for the M&O $ 0.13201 $0.11453 $ (0.01748)

municipality. I&S $ 0.02399 $0.04565 $ 0.021660

$ 0.15600 $0.16018 $0.00418

The breakout for general operations is $0.11453

and generates approximately $1.6M, while the portion for debt service is $0.04565 and results in

$709,201 for our debt obligations shown below:

• 2011 Certificates of Obligation payment for street projects of $119,756

• 2013 General Obligation Refunding payment of $171,465 for the Sam and Margaret Lee Arts &

Science Center construction

• 2013 Certificates of Obligation payment for the Westlake Academy construction expansion of

$417,980

5