Page 142 - City of Westlake FY20 Budget

P. 142

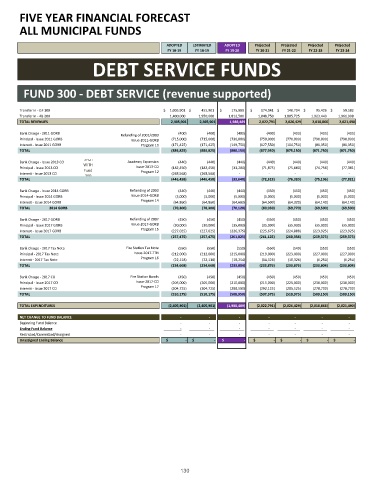

FIVE YEAR FINANCIAL FORECAST

ALL MUNICIPAL FUNDS

Revision 06

ADOPTED ESTIMATED ADOPTED Projected Projected Projected Projected

FY 18‐19 FY 18‐19 FY 19‐20 FY 20‐21 FY 21‐22 FY 22‐23 FY 23‐24

#

# DEBT SERVICE FUNDS

#

#

#

#

# FUND 300 ‐ DEBT SERVICE (revenue supported)

#

#

# Transfer in ‐ GF 100 $ 1,005,901 $ 455,901 $ 175,989 $ 174,041 $ 140,704 $ 95,426 $ 59,582

# Transfer In ‐ 4B 200 1,400,000 1,950,000 1,812,500 1,848,750 1,885,725 1,923,440 1,961,908

# TOTAL REVENUES 2,405,901 2,405,901 1,988,489 2,022,791 2,026,429 2,018,866 2,021,490

#

# Bank Charge ‐ 2011 GORB Refunding of 2002/2003 (400) (400) (400) (400) (400) (400) (400)

# Principal ‐ Issue 2011 GORB Issue‐2011‐GORB (715,000) (715,000) (730,000) (750,000) (770,000) (790,000) (790,000)

# Interest ‐ Issue 2011 GORB Program 10 (171,425) (171,425) (149,750) (127,550) (104,750) (81,350) (81,350)

# TOTAL (886,825) (886,825) (880,150) (877,950) (875,150) (871,750) (871,750)

#

# Bank Charge ‐ Issue 2013 CO SPLIT Academy Expansion (440) (440) (440) (440) (440) (440) (440)

# Principal ‐ Issue 2013 CO WITH Issue‐2013‐CO (182,450) (182,450) (33,200) (71,875) (75,880) (74,756) (77,381)

Fund

# Interest ‐ Issue 2013 CO Program 12 (263,568) (263,568) ‐ ‐ ‐ ‐ ‐

300

# TOTAL (446,458) (446,458) (33,640) (72,315) (76,320) (75,196) (77,821)

#

# Bank Charge ‐ Issue 2014 GORB Refunding of 2003 (440) (440) (440) (450) (450) (450) (450)

# Principal ‐ Issue 2014 GORB Issue‐2014‐GORB (5,000) (5,000) (5,000) (5,000) (5,000) (5,000) (5,000)

# Interest ‐ Issue 2014 GORB Program 14 (64,860) (64,860) (64,680) (64,500) (64,320) (64,140) (64,140)

# TOTAL 2014 GORB (70,300) (70,300) (70,120) (69,950) (69,770) (69,590) (69,590)

#

# Bank Charge ‐ 2017 GORB Refunding of 2007 (450) (450) (450) (450) (450) (450) (450)

# Principal ‐ Issue 2017 GORB Issue‐2017‐GORB (30,000) (30,000) (35,000) (35,000) (35,000) (35,000) (35,000)

# Interest ‐ Issue 2017 GORB Program 15 (227,025) (227,025) (226,375) (225,675) (224,888) (223,925) (223,925)

# TOTAL (257,475) (257,475) (261,825) (261,125) (260,338) (259,375) (259,375)

#

# Bank Charge ‐ 2017 Tax Note Fire Station Tax Note (550) (550) (550) (550) (549) (550) (550)

# Principal ‐ 2017 Tax Note Issue‐2017‐TTN (212,000) (212,000) (215,000) (219,000) (223,000) (227,000) (227,000)

# Interest ‐ 2017 Tax Note Program 16 (22,118) (22,118) (18,254) (14,326) (10,326) (6,254) (6,254)

# TOTAL (234,668) (234,668) (233,804) (233,876) (233,876) (233,804) (233,804)

#

# Bank Charge ‐ 2017 CO Fire Station Bonds (450) (450) (450) (450) (450) (450) (450)

# Principal ‐ Issue 2017 CO Issue‐2017‐CO (205,000) (205,000) (210,000) (215,000) (225,000) (230,000) (230,000)

# Interest ‐ Issue 2017 CO Program 17 (304,725) (304,725) (298,500) (292,125) (285,525) (278,700) (278,700)

# TOTAL (510,175) (510,175) (508,950) (507,575) (510,975) (509,150) (509,150)

#

# TOTAL EXPENDITURES (2,405,901) (2,405,901) (1,988,489) (2,022,791) (2,026,429) (2,018,866) (2,021,490)

#

# NET CHANGE TO FUND BALANCE ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Beginning Fund Balance ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Ending Fund Balance ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Restricted/Committed/Assigned ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Unassigned Ending Balance $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

#

#

#

#

130