Page 140 - City of Westlake FY20 Budget

P. 140

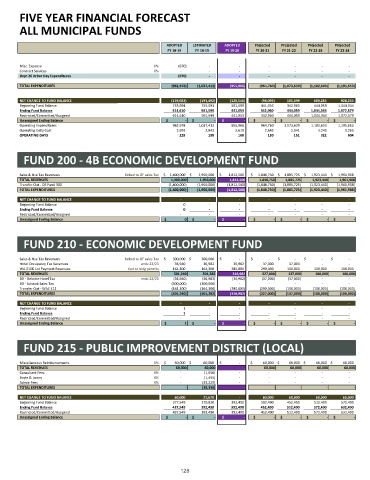

FIVE YEAR FINANCIAL FORECAST

ALL MUNICIPAL FUNDS

Revision 06

ADOPTED ESTIMATED ADOPTED Projected Projected Projected Projected

FY 18‐19 FY 18‐19 FY 19‐20 FY 20‐21 FY 21‐22 FY 22‐23 FY 23‐24

#

# Misc. Expense 0% (670) ‐ ‐ ‐ ‐ ‐ ‐

# Contract Services 0% ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Dept 26 Arbor Day Expenditures (670) ‐ ‐ ‐ ‐ ‐ ‐

#

# TOTAL EXPENDITURES (982,978) (1,037,412) (955,966) (964,760) (1,073,639) (1,182,603) (1,191,653)

#

#

# NET CHANGE TO FUND BALANCE (139,083) (193,492) (120,546) (98,093) 101,099 600,285 928,235

# Beginning Fund Balance 753,694 755,091 561,599 441,053 342,960 444,059 1,044,344

# Ending Fund Balance 614,610 561,599 441,053 342,960 444,059 1,044,344 1,972,579

# Restricted/Committed/Assigned 614,610 561,599 441,053 342,960 444,059 1,044,344 1,972,579

# Unassigned Ending Balance $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

# Operating Expenditures 982,978 1,037,412 955,966 964,760 1,073,639 1,182,603 1,191,653

# Operating Daily Cost 2,693 2,842 2,619 2,643 2,941 3,240 3,265

# OPERATING DAYS 228 198 168 130 151 322 604

#

#

#

#

# FUND 200 ‐ 4B ECONOMIC DEVELOPMENT FUND

#

#

# Sales & Use Tax Revenues linked to GF sales Tax $ 1,400,000 $ 1,950,000 $ 1,812,500 $ 1,848,750 $ 1,885,725 $ 1,923,440 $ 1,961,908

# TOTAL REVENUES 1,400,000 1,950,000 1,812,500 1,848,750 1,885,725 1,923,440 1,961,908

# Transfer Out ‐ DS Fund 300 (1,400,000) (1,950,000) (1,812,500) (1,848,750) (1,885,725) (1,923,440) (1,961,908)

# TOTAL EXPENDITURES (1,400,000) (1,950,000) (1,812,500) (1,848,750) (1,885,725) (1,923,440) (1,961,908)

#

# NET CHANGE TO FUND BALANCE ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Beginning Fund Balance 0 ‐ ‐ ‐ ‐ ‐ ‐

# Ending Fund Balance 0 ‐ ‐ ‐ ‐ ‐ ‐

# Restricted/Committed/Assigned ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Unassigned Ending Balance $ 0 $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

#

#

#REF!

#

# FUND 210 ‐ ECONOMIC DEVELOPMENT FUND

#

#

# Sales & Use Tax Revenues linked to GF sales Tax $ 300,000 $ 300,000 $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

# Hotel Occupancy Tax Revenues ends 22/23 36,940 36,982 36,982 37,000 37,000 ‐ ‐

# WA $10K Lot Payment Revenues tied to bldg permits 164,300 164,300 280,000 290,000 100,000 100,000 100,000

# TOTAL REVENUES 501,240 501,282 316,982 327,000 137,000 100,000 100,000

# ED ‐ Deloitte Hotel Tax ends 22/23 (36,940) (36,982) (36,982) (37,000) (37,000) ‐ ‐

# ED ‐ Schwab Sales Tax (300,000) (300,000) ‐ ‐ ‐ ‐ ‐

# Transfer Out ‐ WAE 412 (164,300) (164,300) (280,000) (290,000) (100,000) (100,000) (100,000)

# TOTAL EXPENDITURES (501,240) (501,282) (316,982) (327,000) (137,000) (100,000) (100,000)

#

# NET CHANGE TO FUND BALANCE ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Beginning Fund Balance 1 ‐ ‐ ‐ ‐ ‐ ‐

# Ending Fund Balance 1 ‐ ‐ ‐ ‐ ‐ ‐

# Restricted/Committed/Assigned ‐ ‐ ‐ ‐ ‐ ‐ ‐

# Unassigned Ending Balance $ 1 $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

#

#REF!

#REF!

#

# FUND 215 ‐ PUBLIC IMPROVEMENT DISTRICT (LOCAL)

#

#

# Miscellaneous Reimbursements 0% $ 60,000 $ 60,000 $ ‐ $ 60,000 $ 60,000 $ 60,000 $ 60,000

# TOTAL REVENUES 60,000 60,000 ‐ 60,000 60,000 60,000 60,000

# Consultant Fees 0% ‐ (1,650) ‐ ‐ ‐ ‐ ‐

# Boyle & Lowry 0% ‐ (1,455) ‐ ‐ ‐ ‐ ‐

# Admin Fees 0% ‐ (35,225) ‐ ‐ ‐ ‐ ‐

# TOTAL EXPENDITURES ‐ (38,330) ‐ ‐ ‐ ‐ ‐

#

# NET CHANGE TO FUND BALANCE 60,000 21,670 ‐ 60,000 60,000 60,000 60,000

# Beginning Fund Balance 377,549 370,820 392,490 392,490 452,490 512,490 572,490

# Ending Fund Balance 437,549 392,490 392,490 452,490 512,490 572,490 632,490

# Restricted/Committed/Assigned 437,549 392,490 392,490 452,490 512,490 572,490 632,490

# Unassigned Ending Balance $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐ $ ‐

#

#REF!

#

128