Page 48 - NRH FY20 Approved Budget

P. 48

BUDGET OVERVIEW

General Fund FY 2019/2020 Adopted Budget

Revenue Overview

The General Fund provides for the tax supported operations of the City. These include services

traditionally thought of when referring to City operations such as Police, Fire, Streets, Library,

etc. The major sources of revenue in this fund are property taxes representing 36% of General

Fund revenues, and sales taxes representing 22% of General Fund revenues.

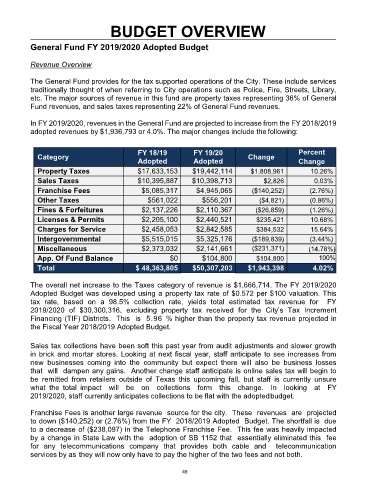

In FY 2019/2020, revenues in the General Fund are projected to increase from the FY 2018/2019

adopted revenues by $1,936,793 or 4.0%. The major changes include the following:

FY 18/19 FY 19/20 Percent

Category Change

Adopted Adopted Change

Property Taxes $17,633,153 $19,442,114 $1,808,961 10.26%

Sales Taxes $10,395,887 $10,398,713 $2,826 0.03%

Franchise Fees $5,085,317 $4,945,065 ($140,252) (2.76%)

Other Taxes $561,022 $556,201 ($4,821) (0.86%)

Fines & Forfeitures $2,137,226 $2,110,367 ($26,859) (1.26%)

Licenses & Permits $2,205,100 $2,440,521 $235,421 10.68%

Charges for Service $2,458,053 $2,842,585 $384,532 15.64%

Intergovernmental $5,515,015 $5,325,176 ($189,839) (3.44%)

Miscellaneous $2,373,032 $2,141,661 ($231,371) (14.78%)

App. Of Fund Balance $0 $104,800 $104,800 100%

Total $ 48,363,805 $50,307,203 $1,943,398 4.02%

The overall net increase to the Taxes category of revenue is $1,666,714. The FY 2019/2020

Adopted Budget was developed using a property tax rate of $0.572 per $100 valuation. This

tax rate, based on a 98.5% collection rate, yields total estimated tax revenue for FY

2019/2020 of $30,300,316, excluding property tax received for the City’s Tax Increment

Financing (TIF) Districts. This is 5.96 % higher than the property tax revenue projected in

the Fiscal Year 2018/2019 Adopted Budget.

Sales tax collections have been soft this past year from audit adjustments and slower growth

in brick and mortar stores. Looking at next fiscal year, staff anticipate to see increases from

new businesses coming into the community but expect there will also be business losses

that will dampen any gains. Another change staff anticipate is online sales tax will begin to

be remitted from retailers outside of Texas this upcoming fall, but staff is currently unsure

what the total impact will be on collections form this change. In looking at FY

2019/2020, staff currently anticipates collections to be flat with the adopted budget.

Franchise Fees is another large revenue source for the city. These revenues are projected

to down ($140,252) or (2.76%) from the FY 2018/2019 Adopted Budget. The shortfall is due

to a decrease of ($238,097) in the Telephone Franchise Fee. This fee was heavily impacted

by a change in State Law with the adoption of SB 1152 that essentially eliminated this fee

for any telecommunications company that provides both cable and telecommunication

services by as they will now only have to pay the higher of the two fees and not both.

48