Page 23 - NRH FY20 Approved Capital Budget

P. 23

CAPITAL IMPROVEMENT PROGRAM OVERVIEW

2012 Bond Election Program

During spring 2011, the Community Improvements Task Force was formed to evaluate the current

facility and infrastructure needs. The evaluation was conducted in an eight month period. The task

force recommendation to Council was for the City to construct a new municipal complex. This

recommendation was made after the task force studied the existing location of city services and

departments concluding the Loop 820 expansion impacted city services provided at City Hall, Police

Department, Municipal Court, and Park Administration.

On May 12, 2012, voters elected in favor of the City issuing $48,000,000 in bonds to help fund a new

municipal complex. The new municipal complex will serve as a consolidated location for City Hall,

Police Department, Municipal Court, Parks Administration, Citicable, Fire Administration, Emergency

Management, and Neighborhood Services.

Prior to the 2012 tax year, the City maintained the same tax rate of $0.57 for 19 years. The approval

of the $48 million in the bond election resulted in the City reviewing the $0.57 tax rate. After review,

Council voted to increase the 2012 Tax Rate by 7% to $0.61.

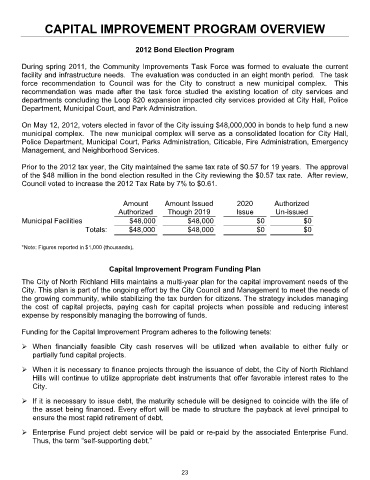

Amount Amount Issued 2020 Authorized

Authorized Though 2019 Issue Un-issued

Municipal Facilities $48,000 $48,000 $0 $0

Totals: $48,000 $48,000 $0 $0

*Note: Figures reported in $1,000 (thousands).

Capital Improvement Program Funding Plan

The City of North Richland Hills maintains a multi-year plan for the capital improvement needs of the

City. This plan is part of the ongoing effort by the City Council and Management to meet the needs of

the growing community, while stabilizing the tax burden for citizens. The strategy includes managing

the cost of capital projects, paying cash for capital projects when possible and reducing interest

expense by responsibly managing the borrowing of funds.

Funding for the Capital Improvement Program adheres to the following tenets:

When financially feasible City cash reserves will be utilized when available to either fully or

partially fund capital projects.

When it is necessary to finance projects through the issuance of debt, the City of North Richland

Hills will continue to utilize appropriate debt instruments that offer favorable interest rates to the

City.

If it is necessary to issue debt, the maturity schedule will be designed to coincide with the life of

the asset being financed. Every effort will be made to structure the payback at level principal to

ensure the most rapid retirement of debt.

Enterprise Fund project debt service will be paid or re-paid by the associated Enterprise Fund.

Thus, the term “self-supporting debt.”

23